US Treasury Cracks Down on Crypto Wallets Tied to Terrorism and Money Laundering

The US Treasury Department has sanctioned eight cryptocurrency wallets linked to Russian exchange Garantex and Yemen's Houthi movement after discovering nearly $1 billion in suspicious transactions. The crackdown highlights cryptocurrency's growing role in financing terrorism and signals increased regulatory scrutiny of both centralized and decentralized platforms.

Bitcoin Struggles to Break $89K Resistance as Economic Factors Overshadow Trade War Impact

Bitcoin continues trading below $89,000 since early March, with analysis revealing the downturn preceded US-China trade tensions. Despite robust institutional engagement through spot ETFs and major purchases, the cryptocurrency faces headwinds from moderating inflation and broader economic concerns.

Wyoming Pioneers First State-Backed Stablecoin with WYST Launch

Wyoming announces testing of WYST, the first US state-issued stablecoin backed by cash and Treasuries, set to launch in July 2025. The innovative project will operate across multiple blockchain networks while directing generated interest to the state's education fund.

U.S. Treasury Lifts Controversial Tornado Cash Sanctions After Court Ruling

The U.S. Treasury has removed sanctions against cryptocurrency mixer Tornado Cash following a court ruling that challenged OFAC's authority. While celebrating innovation in digital assets, officials maintain vigilance against illicit activities as legal proceedings continue against platform founders.

Trump's Gold-to-Bitcoin Proposal: A New Era for US Reserve Assets?

Former President Trump's administration proposes converting government gold reserves to Bitcoin through a 'budget-neutral' approach, marking a significant shift in cryptocurrency policy. The controversial plan could reshape national reserve asset management while facing implementation challenges and market implications.

Hong Kong Investment Firm Expands Bitcoin Holdings with Strategic $858K Purchase

HK Asia Holdings has bolstered its cryptocurrency portfolio by acquiring 10 additional Bitcoin, bringing total holdings to 18.88 BTC valued at $1.72 million. The company's transparent investment approach has driven significant stock price gains while joining other public firms embracing Bitcoin as a hedge against fiat currency risks.

Australia Unveils Ambitious Crypto Integration Plan with New Regulatory Framework

Australian Treasury reveals comprehensive strategy to regulate digital assets and integrate crypto into the national financial system, introducing Digital Asset Platforms licensing framework. The initiative addresses de-banking issues and aims to transform Australia's financial landscape by 2025.

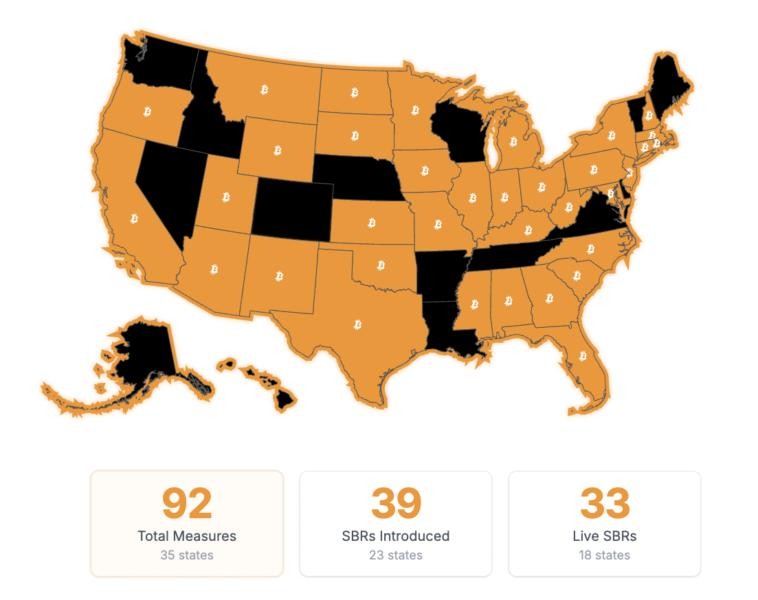

Minnesota Pioneers Crypto Integration with Bold Bitcoin Investment Bill

Minnesota State Senator Jeremy Miller introduces groundbreaking legislation allowing state investments in Bitcoin and cryptocurrencies. The Minnesota Bitcoin Act would enable crypto tax payments, retirement account inclusion, and tax exemptions on gains, positioning the state at the forefront of digital asset adoption.

Trump Administration Plans Major Bitcoin Acquisition Strategy for National Reserves

Former President Trump's administration unveils ambitious plans to acquire substantial Bitcoin holdings through budget-neutral methods, positioning the US as a digital asset leader. The initiative, spearheaded by crypto advisers Bo Hines and David Sacks, marks a significant shift in government approach to cryptocurrency assets.

Authorities Recover $31M in Crypto Assets from Major Uranium Finance Heist

Federal authorities have seized $31 million in cryptocurrency linked to the 2021 Uranium Finance hack, marking a significant breakthrough in the case. The recovery follows a complex investigation into one of DeFi's largest exploits, where attackers stole $50 million through smart contract vulnerabilities.