22 US States Consider Historic Bitcoin Reserve Legislation Worth $23.7 Billion

Nearly two dozen US states are exploring groundbreaking legislation to establish Bitcoin reserves, potentially accumulating 247,000 BTC valued at $23.7 billion. The widespread initiative, led by states like Texas and Florida, signals growing mainstream acceptance of cryptocurrency for public fund management.

US Strategic Bitcoin Reserve Could Manage 35% of National Debt by 2050, VanEck Projects

Investment firm VanEck proposes an ambitious plan for the US government to acquire 1 million Bitcoin by 2050 as a strategic reserve asset. The analysis suggests this could help manage up to 35% of domestic debt, though the strategy faces potential creditor resistance and market challenges.

VanEck Projects Major Crypto Correction Before Record Highs in 2025

Investment giant VanEck forecasts a 30% Bitcoin correction in Q1 2025 followed by an explosive rally to $180,000 by year-end. The firm also predicts major institutional developments including potential government Bitcoin reserves and widespread asset tokenization reaching $50 billion.

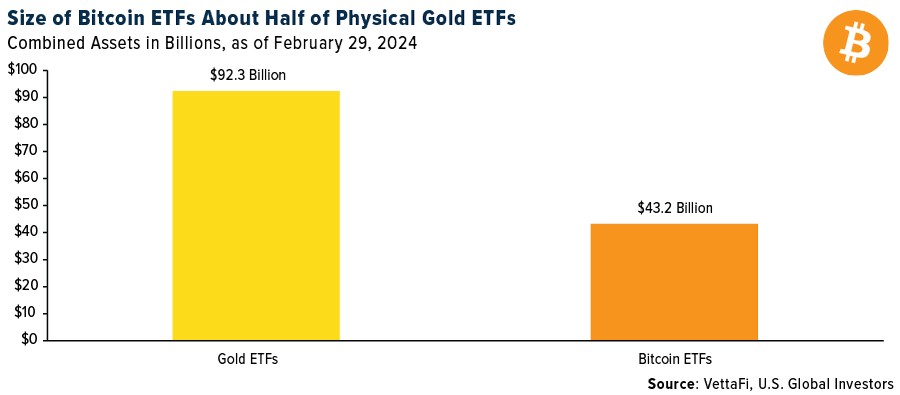

Bitcoin ETFs Could Surpass Gold ETFs in Record Time as Institutional Adoption Soars

US Bitcoin ETFs are rapidly closing the $23 billion gap with gold ETFs and could overtake them by Christmas, driven by strong institutional demand and Bitcoin's stellar performance. BlackRock's IBIT leads the charge with $48.4 billion in assets while Bitcoin hits new highs near $100,000.

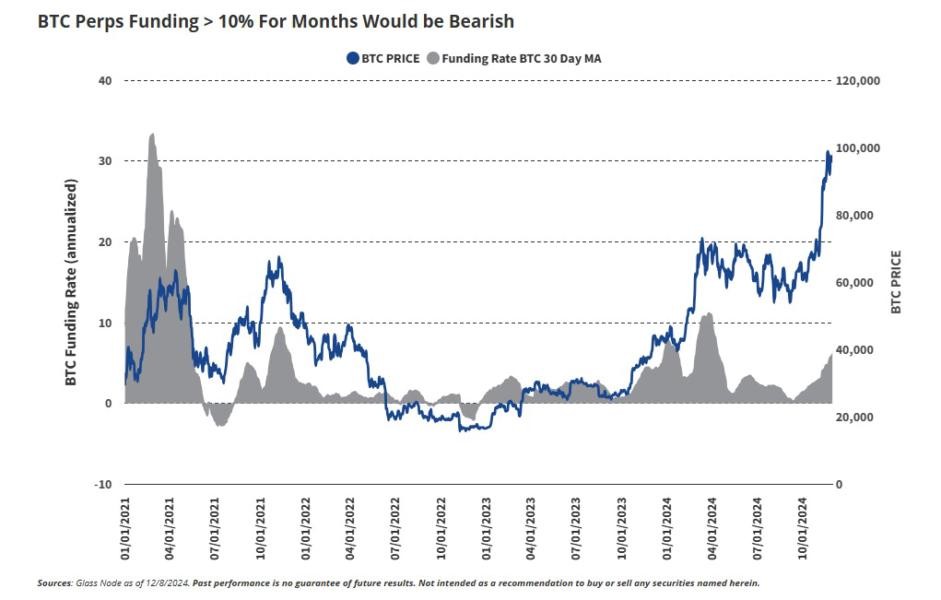

VanEck Predicts Bitcoin to Hit $180,000 as Market Shows Early Bull Run Signs

Investment giant VanEck maintains its ambitious $180,000 Bitcoin price target, citing multiple indicators that suggest the current bull market is in its early stages. Key metrics including futures funding rates, relative unrealized profit, and retail participation levels point to significant upside potential.