In a remarkable display of institutional interest, Bitcoin exchange-traded funds (ETFs) in the United States witnessed an unprecedented surge of inflows on November 7, totaling a staggering $1.37 billion. This milestone comes as Bitcoin reached new all-time highs, approaching $77,000 in the wake of Donald Trump's presidential election victory and the Federal Reserve's decision to reduce interest rates.

BlackRock Leads the Charge

The lion's share of this influx was captured by BlackRock's IBIT fund, which alone saw $1.12 billion in new investments. This single-day record for the product since its January launch has propelled BlackRock's total Bitcoin ETF assets under management to an impressive $32.8 billion, representing 432,674 BTC.

Eric Balchunas, a senior ETF analyst at Bloomberg, expressed surprise at the magnitude of the inflow, stating it was "by far [the] biggest one-day flow of any BTC ETF ever."

Other Players in the Field

While BlackRock dominated the inflows, other ETF providers also saw significant interest:

- Fidelity's Bitcoin ETF (FBTC) attracted $191 million

- Bitwise, Ark 21Shares, and Grayscale each saw inflows between $13 million and $20 million

The total invested in spot Bitcoin ETFs has now reached $25.5 billion, according to data from Farside Investors.

Ethereum ETFs Join the Party

The enthusiasm wasn't limited to Bitcoin. Ethereum ETFs experienced their largest inflow day since August 6, with $79.7 million entering these funds. BlackRock and Fidelity once again led the pack, with their respective Ethereum ETFs receiving $23.7 million and $28.9 million in new investments.

Market Implications

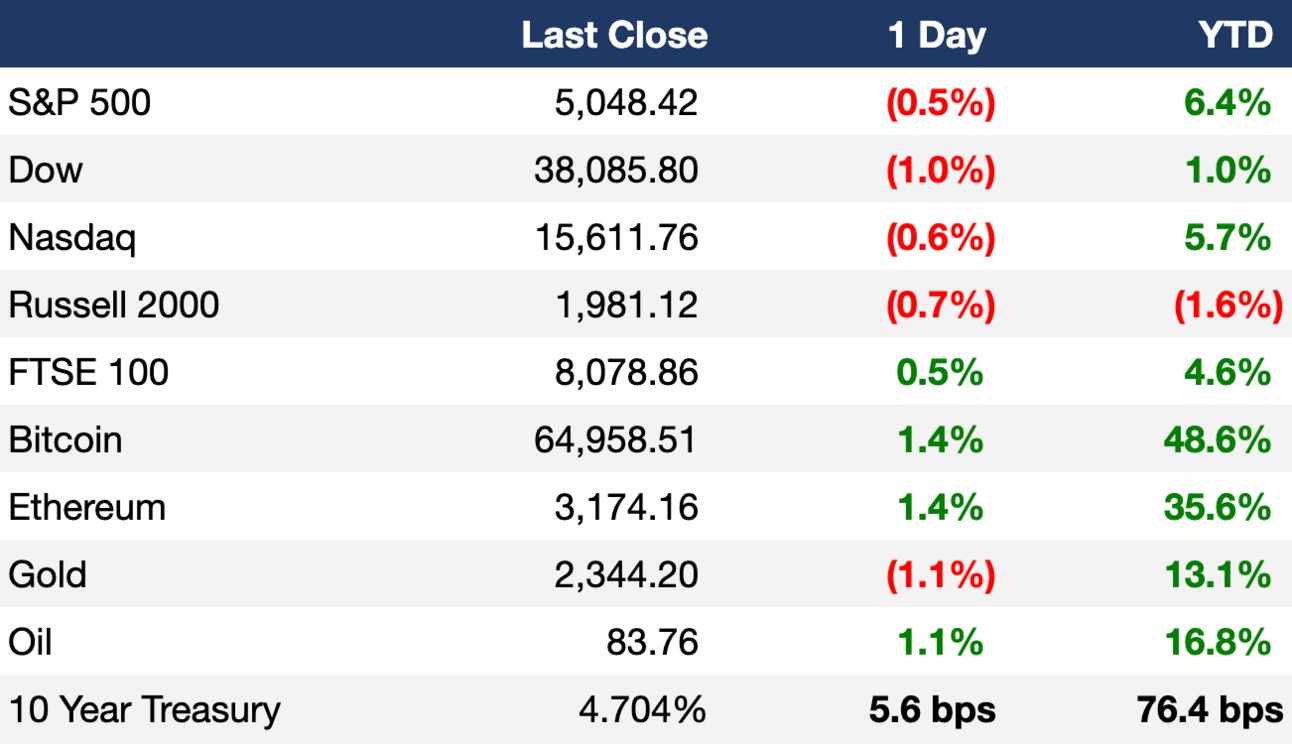

This surge in institutional investment comes at a time of heightened optimism in the cryptocurrency market. The record inflows coincide with Bitcoin's recent price surge and overall bullish sentiment in the crypto space.

The influx of institutional money through ETFs represents a significant shift in how traditional investors are gaining exposure to digital assets. It suggests growing confidence in cryptocurrencies as a legitimate asset class and could potentially lead to further mainstream adoption.

As the crypto market continues to evolve, the role of institutional investors and regulated investment products like ETFs is likely to become increasingly prominent, potentially reshaping the landscape of digital asset investment.