Bitcoin plunged below $90,000 this week, reaching its lowest level since November as multiple headwinds hit the cryptocurrency market. The world's largest digital currency dropped over 10% to $86,097 on February 25, marking a sharp decline from its all-time high of $109,228 reached during President Trump's inauguration in January.

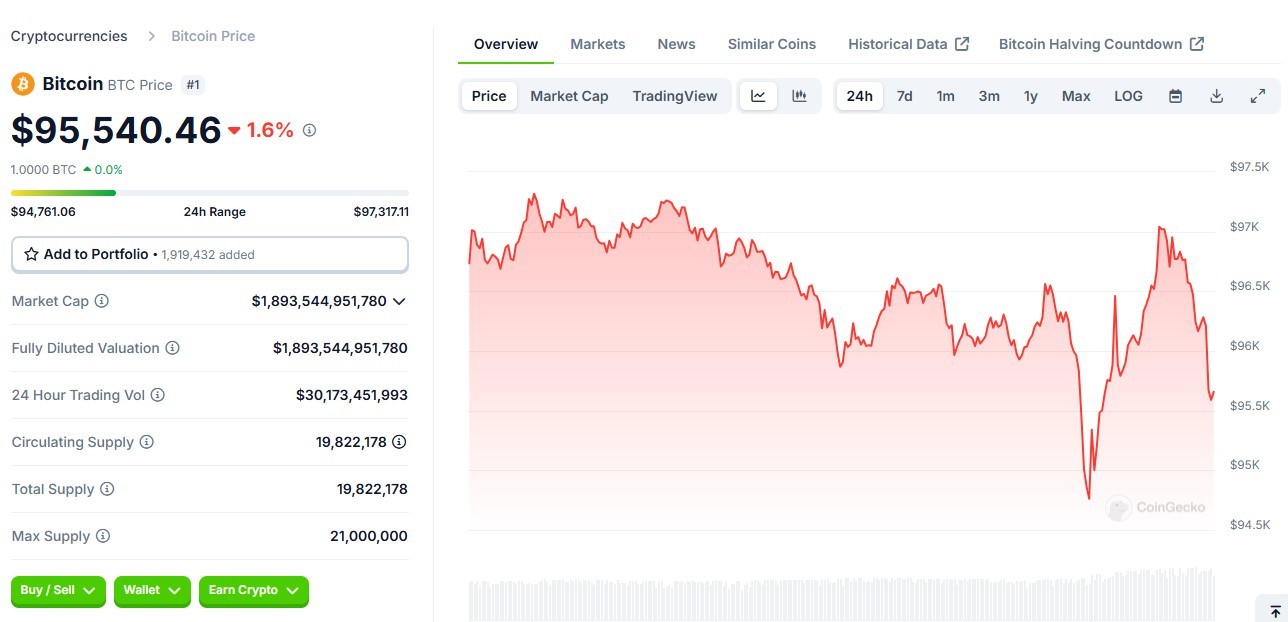

The steep sell-off wiped nearly half a trillion dollars from the total cryptocurrency market capitalization, with Bitcoin currently trading around $88,256 as of Wednesday.

Several factors contributed to the downward pressure. U.S.-listed Bitcoin spot ETFs experienced major outflows, with investors withdrawing $938 million from 11 different funds. Market confidence was further shaken by President Trump's recent announcement of new tariffs on imports from China, Mexico, and Canada.

Adding to market jitters was a massive security breach at Dubai-based exchange Bybit, where hackers stole approximately $1.5 billion in digital assets - the largest cryptocurrency theft recorded to date.

Standard Chartered analysts have warned of potential further declines, noting that while falling Treasury yields could support Bitcoin long-term, continued ETF outflows may delay any meaningful recovery.

The cryptocurrency's price action reflects broader market uncertainty around Federal Reserve interest rate policies and the impact of new trade restrictions on economic growth. While some remain optimistic about Bitcoin's long-term prospects, the immediate outlook suggests continued volatility as markets digest multiple challenging developments.

The current price represents a nearly 20% drop from Bitcoin's peak, with analysts watching the $86,000 level as a key support zone that could trigger steeper declines if breached.