In a historic moment for cryptocurrency markets, Bitcoin breached the $100,000 mark during Asian trading hours, triggering massive market movements and delivering unprecedented revenue opportunities for Bitcoin miners.

The price milestone sparked one of the largest liquidation events in recent memory, with over $675 million worth of trading positions being forcefully closed across various cryptocurrencies. Bitcoin-specific liquidations accounted for $180 million of this total.

The market volatility affected more than 213,000 traders, with the single largest liquidation being a $8.9 million short position on the Bybit exchange. Despite the overall bullish trend, data showed that 56% of liquidated positions were actually long trades were caught off guard by sudden price movements.

Other major cryptocurrencies also experienced substantial liquidations, with Ethereum traders losing over $90 million. Popular tokens like XRP, Dogecoin, and Solana collectively saw more than $100 million in position liquidations.

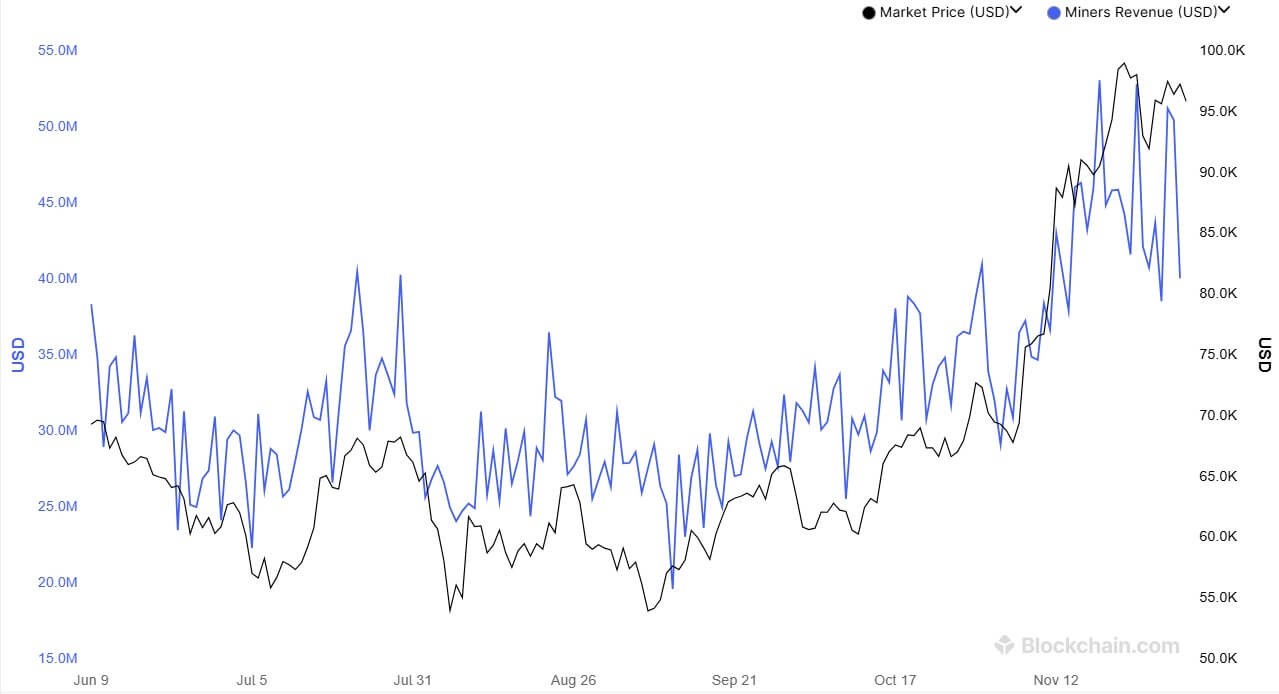

The unprecedented Bitcoin price levels are particularly beneficial for mining operations, as higher prices typically translate to increased profitability for miners who receive Bitcoin rewards for validating transactions. This price surge represents a remarkable turnaround for the mining sector, which has faced challenges during previous market downturns.

Industry analysts expect mining revenues to continue climbing if Bitcoin maintains its position above the $100,000 threshold, potentially attracting new investments in mining infrastructure and operations.

The historic price achievement marks a new chapter in Bitcoin's evolution, demonstrating its growing mainstream acceptance and maturity as a financial asset.