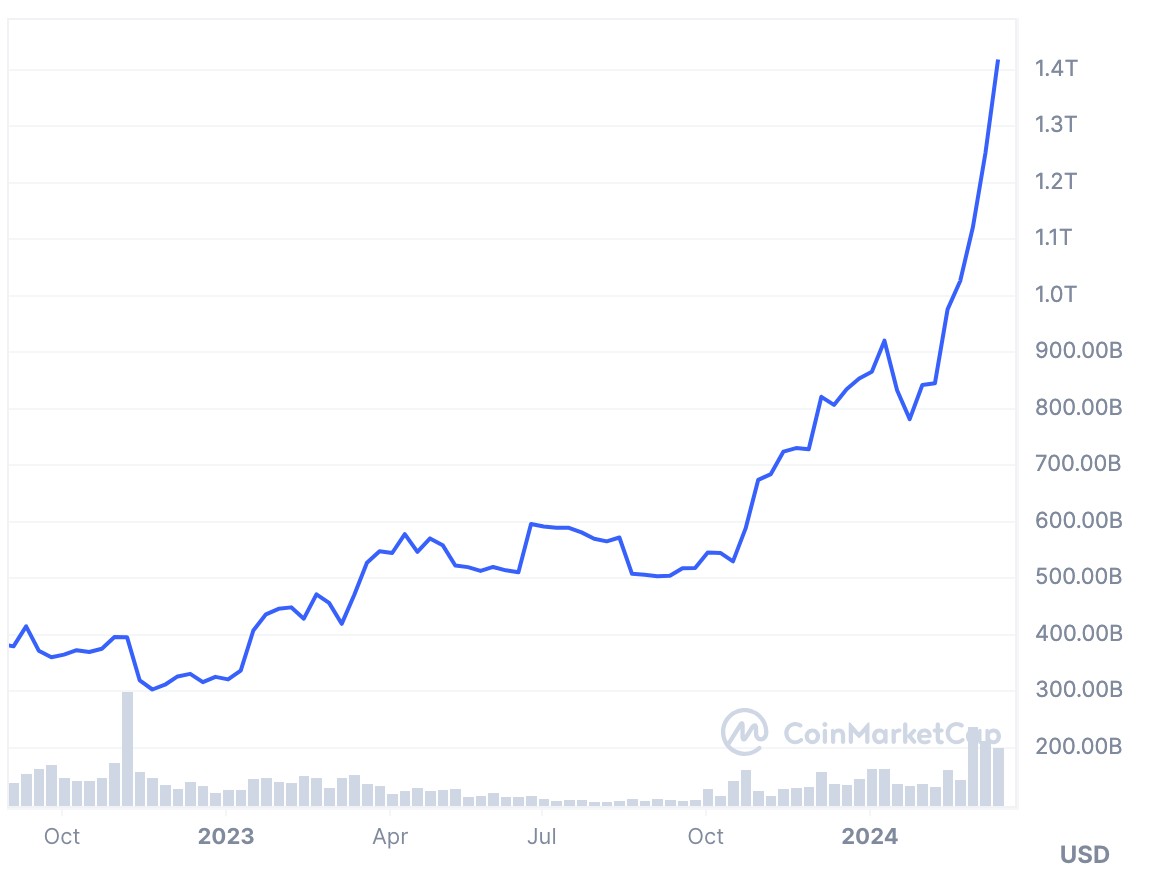

In a historic moment for the cryptocurrency world, Bitcoin has surpassed silver in market capitalization, reaching a staggering $1.74 trillion. This milestone comes as Bitcoin hit a new all-time high of $88,440, showcasing its growing dominance in the global financial landscape.

The surge in Bitcoin's value can be attributed to several factors:

- Increasing institutional adoption

- Rising spot Bitcoin Exchange-Traded Fund (ETF) inflows

- Recent U.S. Federal Reserve decisions

- Speculation around potential U.S. Bitcoin reserves

While this achievement is significant, Bitcoin still has a long way to go before catching up to gold, which boasts a market cap over ten times that of Bitcoin at $17.594 trillion.

ETF Inflows and Institutional Interest

Spot Bitcoin ETFs have seen an incredible influx of capital, with $2.29 billion pouring in over just three trading days. This surge in ETF activity signals growing institutional interest in cryptocurrency, further solidifying Bitcoin's position in the financial world.

The T-Rex 2X Long MicroStrategy Daily Target ETF (MSTU) exemplifies this trend, experiencing a remarkable 52% increase in a single day with over $1 billion in trading volume.

Corporate Adoption

MicroStrategy, the world's largest corporate holder of Bitcoin, has played a significant role in driving Bitcoin's price upward. The company recently announced the purchase of 27,200 BTC for $2.03 billion, bringing its total holdings to 279,420 BTC, valued at $11.9 billion.

Cautionary Notes

Despite the overall bullish sentiment, analysts warn of potential pullbacks. Elevated funding rates in perpetual swaps and high basis yields indicate market euphoria, which historically doesn't last long.

Upcoming macroeconomic events, including the release of the U.S. Consumer Price Index (CPI) and Producer Price Index (PPI), along with a speech from Federal Reserve Chair Jerome Powell, could significantly impact Bitcoin's price direction.

As Bitcoin continues to make headlines and break records, its position as a major player in the global financial system becomes increasingly undeniable. However, investors should remain cautious and stay informed about potential market fluctuations in this rapidly evolving landscape.