Coinbase, America's largest cryptocurrency exchange, has unveiled its market outlook report highlighting five key areas expected to shape the crypto landscape in 2025. The report focuses on stablecoins, asset tokenization, ETFs, DeFi, and regulatory developments.

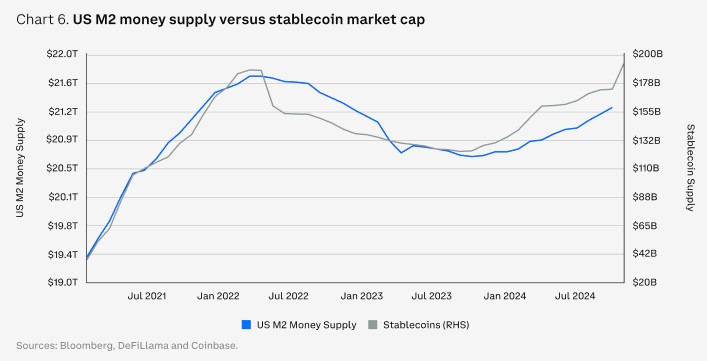

The analysis reveals stablecoins as the standout crypto product of recent times, with market capitalization surging over 50% from $130.5 billion to $204.5 billion in 2023. Transaction volumes have tripled year-over-year, reaching $27 trillion. Coinbase predicts stablecoins will evolve beyond trading to become instrumental in global commerce and capital flows.

Real-world asset tokenization emerges as another promising trend, growing 60% to reach $13.5 billion by December 2023. The report notes expanding use cases beyond U.S. Treasuries, including private credit, commodities, corporate bonds, real estate, and insurance sectors.

The ETF landscape is expected to diversify, with potential approvals for tokens like XRP, Solana, Litecoin, and Hedera. The report suggests that removing SEC's cash mandate for ETF share redemption could attract additional investors to the market. A senior Bloomberg ETF analyst predicts an explosive cryptocurrency market ahead, driven by the potential approval of multiple altcoin exchange-traded funds (ETFs) in the coming years.

In the DeFi sector, lending protocols and decentralized exchanges lead current innovations. New applications, including Decentralized Physical Infrastructure Networks and prediction markets, are projected to gain momentum in 2025.

The report concludes with optimistic regulatory predictions, suggesting the potential emergence of a pro-crypto administration and comprehensive regulatory framework, moving away from the current enforcement-focused approach.

Coinbase analysts emphasize that developments in 2025 could set the crypto industry's direction for decades to come, as wider adoption drives the ecosystem toward its full potential.