Leading cryptocurrency analyst Ali Martinez has revealed a dramatic decline in crypto market capital inflows, dropping from $134 billion to $38 billion in the final month of 2024.

The sharp decrease of over 56% occurred between mid-December 2024 and early January 2025, following an exceptionally strong November performance. This substantial reduction suggests waning investor enthusiasm for digital assets compared to previous months.

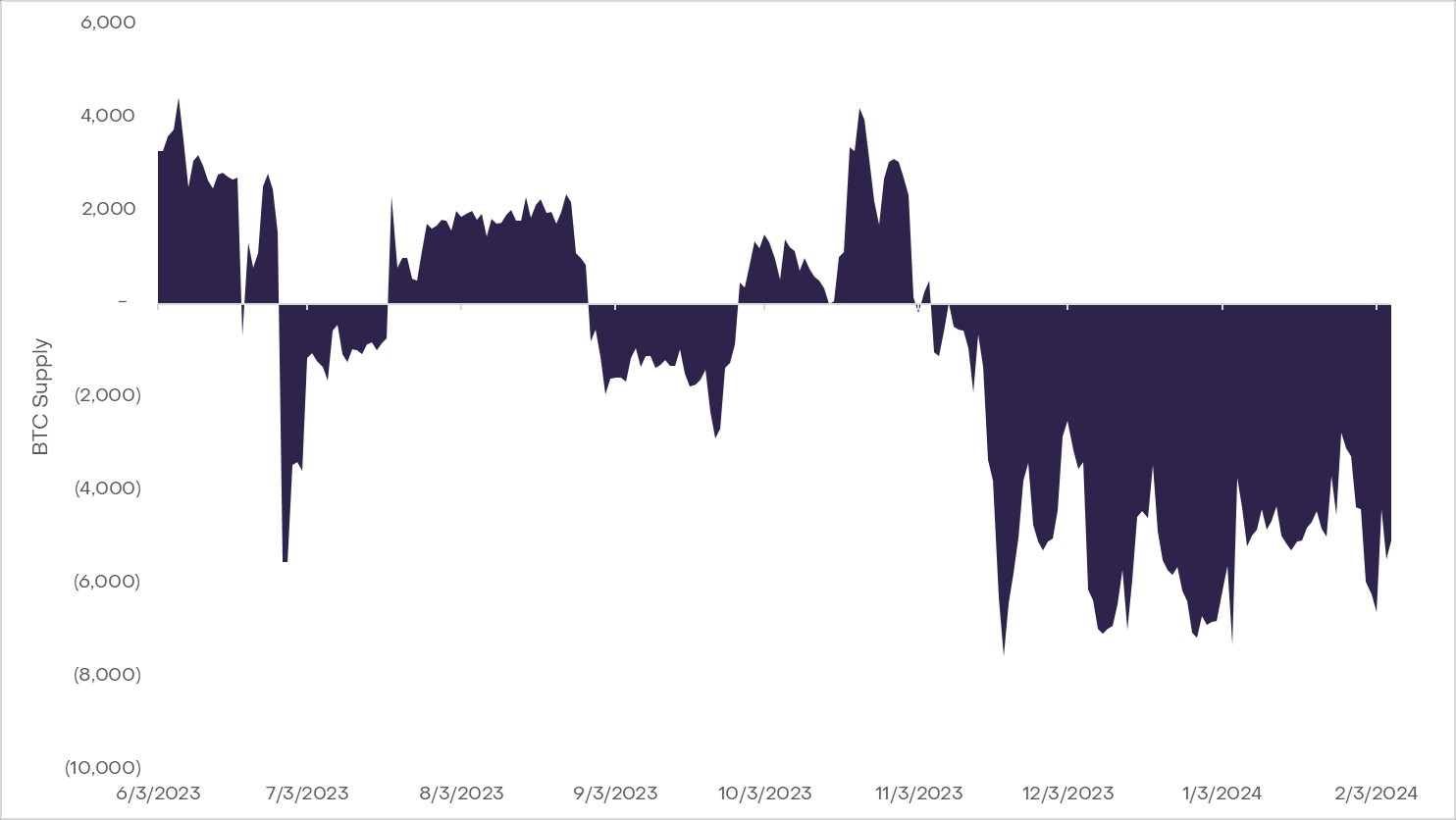

Martinez shared detailed charts demonstrating the aggregated realized value net position change, showing how major cryptocurrencies like Bitcoin and Ethereum typically mirror capital inflow patterns. The data points toward a potential market consolidation phase, where prices commonly experience downward pressure.

However, the stablecoin market presents a different picture. Steady net positions in stablecoins indicate that investors may be strategically repositioning their funds rather than exiting the crypto space entirely. This could signal that traders are waiting for optimal market conditions before reinvesting.

Despite the year-end decline, 2024 proved remarkable for digital asset investments. According to CoinShares' research chief James Butterfill, the year's total inflows into digital asset products reached unprecedented levels - nearly quadrupling the previous record set in 2021.

The final trading days of 2024 saw $75 million in net outflows, but the market showed signs of recovery in early 2025. CoinShares data revealed $585 million flowing into digital asset products within the first three days of the new year, suggesting potential market resilience despite the previous downturn.

The contrasting data between year-end figures and early 2025 activity highlights the dynamic nature of cryptocurrency markets, leaving investors and analysts watching closely for emerging trends in the coming months.