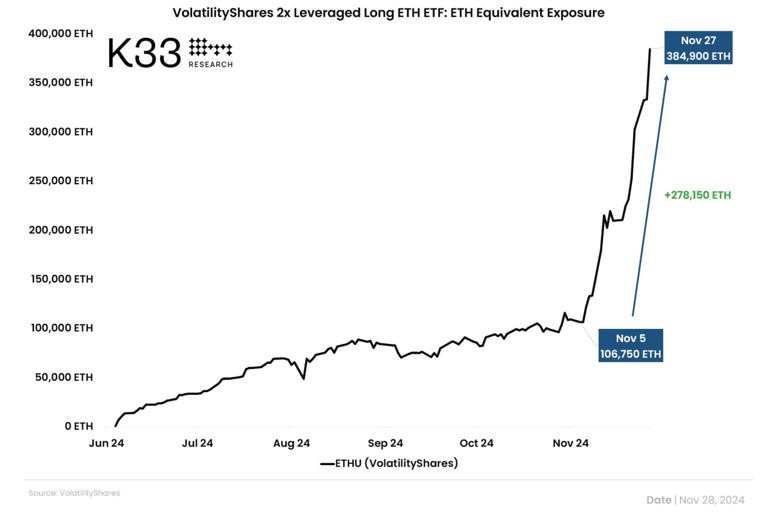

Investor appetite for leveraged Ethereum ETF products has surged dramatically following Trump's presidential victory, with demand rising over 160% amid growing optimism around the cryptocurrency's price trajectory.

Market data shows Ether outpacing Bitcoin in several key metrics, including open interest reaching $8.9 billion compared to Bitcoin's $6.7 billion. The second-largest cryptocurrency has gained over 34% in the past month, edging out Bitcoin's 31% rise.

Industry analysts at Bybit predict Ether could breach the $4,000 mark before January 20th - the date of Trump's presidential inauguration. This bullish outlook stems partly from SEC Chair Gary Gensler's announced departure, coinciding with the incoming administration change.

The institutional interest appears robust, with ETH ETFs recording a four-day winning streak and accumulating more than $90 million worth of Ether on November 27th alone, according to Farside Investors data.

Social media engagement reflects the growing excitement, with Ethereum-related posts on X (formerly Twitter) jumping 282% over three days to reach 1.1 million mentions, as reported by CryptoQuant founder Ki Young Yu.

The futures market shows additional strength, with one-week contracts trading nearly 25% above spot price on an annualized basis. This premium suggests increased institutional participation and potential spot ETF inflows, mirroring patterns previously seen in Bitcoin's market dynamics.

The combination of surging leveraged ETF demand, strong futures yields, and growing institutional interest points to continued momentum in Ethereum's market performance as the cryptocurrency sector anticipates potential regulatory shifts under the incoming Trump administration.