Grayscale Investments has filed for a spot Cardano (ADA) ETF with the U.S. Securities and Exchange Commission (SEC), causing ripples across the cryptocurrency market and driving up interest in the digital asset.

The proposed ETF, which would be Grayscale's first standalone Cardano investment product, aims to provide investors with regulated exposure to ADA without directly holding the cryptocurrency. Coinbase Custody Trust Company will serve as the custodian, while BNY Mellon Asset Servicing will handle administrative responsibilities.

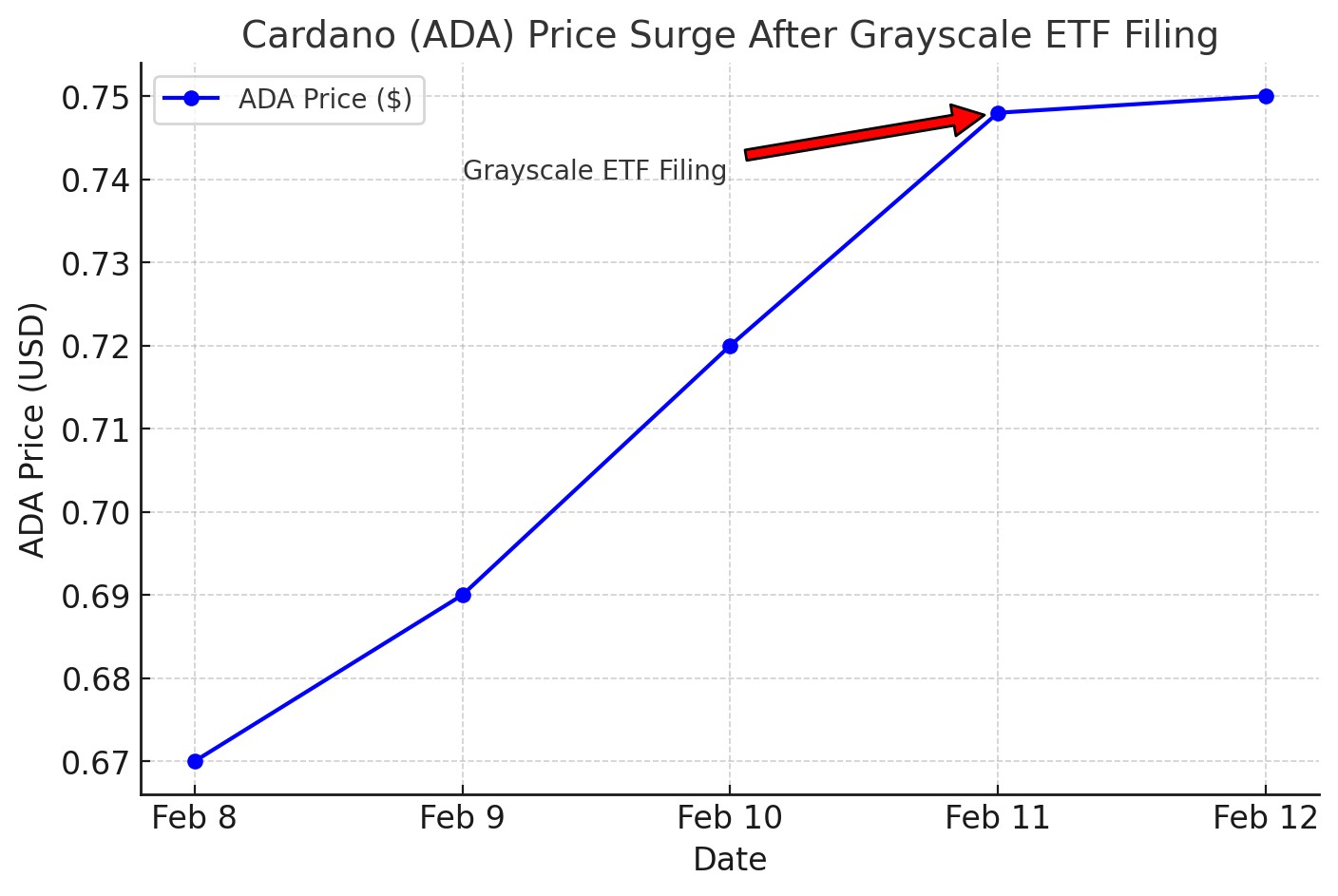

The news triggered a notable price movement for ADA, which reached an intraday high of $0.80. While the token currently trades below its January peak of $1.16, it has posted impressive gains of 140% over the past six months.

Market analysts are watching the SEC's response closely, as approval could open doors for increased institutional investment. The regulatory body's stance on crypto ETFs has evolved recently, with new leadership showing greater openness to digital asset investment products.

The broader spot crypto ETF landscape has seen mixed results in February. While Bitcoin ETFs experienced varying flows, Ethereum ETFs demonstrated stability with minimal outflows.

If approved, the Cardano ETF could reshape the competitive landscape of the cryptocurrency market. The move aligns with growing institutional interest in digital assets and could potentially benefit both investors and the wider crypto industry.

Cardano's eco-friendly proof-of-stake mechanism adds to its appeal, particularly among environmentally conscious investors. However, challenges remain, including market volatility and the need for improved scalability to compete with established blockchain networks.

The path forward for ADA depends heavily on market conditions and regulatory decisions in the coming months. As the crypto community awaits the SEC's verdict, all eyes remain on this developing story that could mark a new chapter in digital finance.