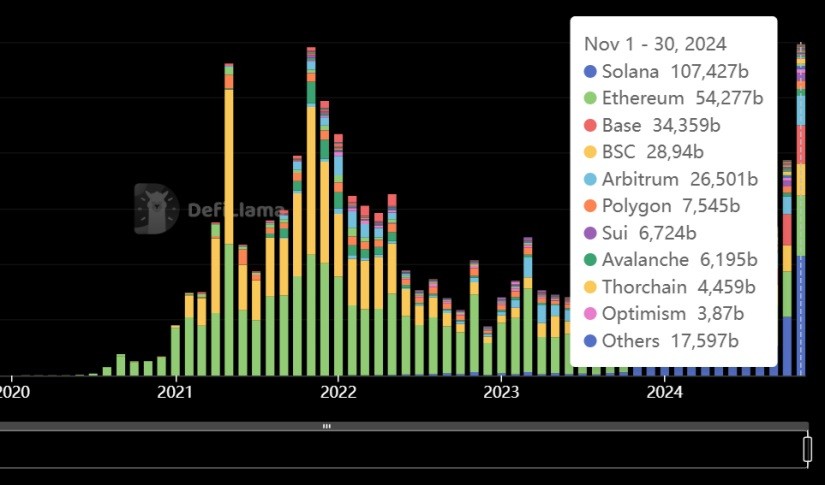

In a remarkable turn of events, Solana's decentralized finance (DeFi) ecosystem has achieved an unprecedented milestone, with its decentralized exchanges (DEX) recording over $100 billion in trading volume this November, surpassing Ethereum's performance by a wide margin.

According to data from DefiLlama, Solana-based DEXes accumulated $116.51 billion in 30-day trading volume, more than doubling Ethereum mainnet's $61.61 billion during the same period. This represents a dramatic 100% increase from Solana's October volume of $52.5 billion.

The surge in trading activity coincides with Solana's impressive milestone touching $263 after recovering from its previous low of $8 during the FTX crisis. The blockchain's Total Value Locked (TVL) has also shown impressive growth, climbing to $9.30 billion from $6.23 billion a month ago.

Several factors have contributed to this explosive growth, including an ongoing memecoin boom, minimal transaction costs, and user-friendly interfaces. The ecosystem's major players include Jito, a liquid staking protocol holding $3.58 billion in TVL, while Jupiter DEX and Raydium maintain approximately $2.4 billion each.

The platform's expanding user base has been equally impressive, with 107.5 million active addresses recorded in November. This surge in adoption has helped fuel SOL's remarkable year-to-date performance, posting gains exceeding 157% since January 1.

Market analysts remain optimistic about Solana's trajectory, with some projecting SOL could reach $400. The potential approval of a Solana exchange-traded fund (ETF) and declining Bitcoin dominance may provide additional momentum for future growth.

The latest achievements mark a dramatic recovery for Solana, which saw its TVL drop to $210 million in January 2023. While current levels remain below the all-time high TVL of $10.02 billion set in November 2021, the platform's recent performance suggests a robust comeback in the DeFi space.