Despite the recent surge in cryptocurrency markets, retail investors appear hesitant to jump back in compared to previous boom cycles, according to industry analysts.

While bitcoin trading activity has increased notably, retail participation remains subdued compared to the pandemic-era crypto frenzy of 2021. Josh Gilbert, market analyst at eToro, notes that although trading volumes are rising, retail engagement hasn't reached previous peak levels, suggesting many individual investors are still watching cautiously from the sidelines.

The current $1 trillion crypto market rally coincided with Donald Trump's election victory, driven largely by institutional investors responding to his campaign promises of crypto-friendly regulation and plans for a U.S. bitcoin stockpile.

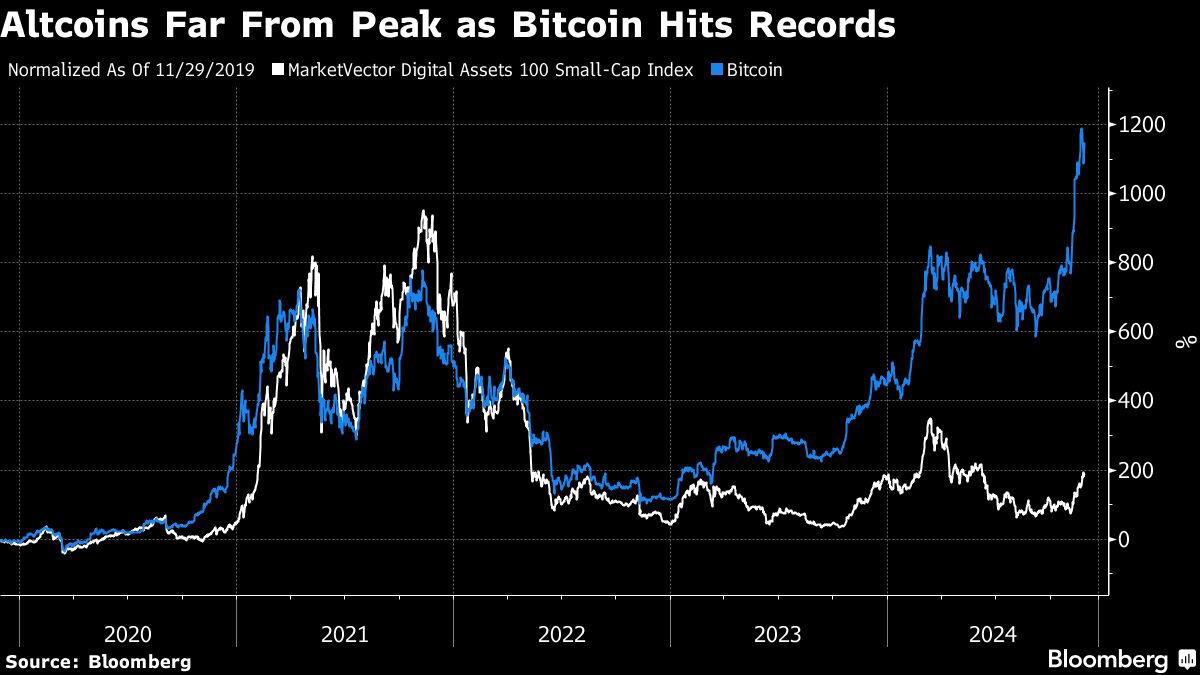

However, some signs point to gradual retail investor re-engagement. Popular alternative cryptocurrency Solana recently hit record highs, while crypto exchange app downloads have increased. Social media activity around meme coins has also picked up.

Caroline Bowler, CEO of BTC Markets, reports that numerous trading accounts dormant since 2020-2021 became active again following the election. This reactivation suggests some retail traders may be testing the waters once more.

The market outlook appears influenced by Trump's pledges to establish the U.S. as a global crypto hub and ease SEC regulatory pressure. Notable industry figures are already positioning themselves, including crypto entrepreneur Justin Sun's recent $30 million investment in Trump-backed World Liberty Financial.

The contrasting narratives between institutional enthusiasm and retail caution highlight the complex dynamics shaping the current crypto market recovery. As memories of the 2021 crash remain fresh, many individual investors appear to be taking a more measured approach to this latest bull run.