Bitcoin Jumps to New Record High of More Than $106,000

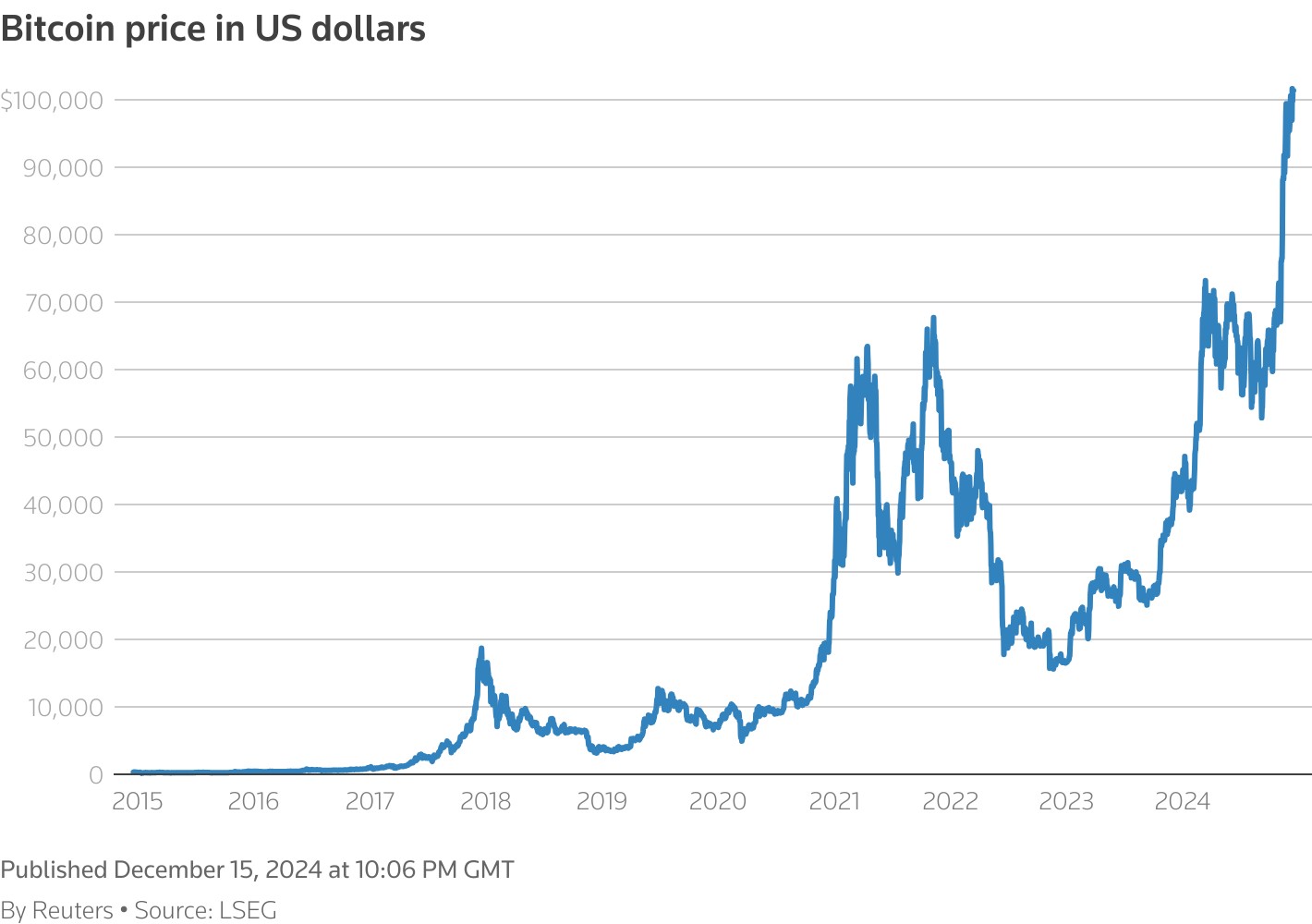

Bitcoin reached an unprecedented milestone on Monday, soaring past $106,000 amid growing enthusiasm fueled by president-elect Donald Trump's suggestion of creating a U.S. Bitcoin strategic reserve.

The world's leading cryptocurrency touched $106,533 before settling at $104,462, marking a 3.2% increase. The digital currency has experienced a remarkable 192% surge this year alone.

The price rally gained momentum after Trump's recent comments on CNBC about establishing a cryptocurrency reserve similar to the nation's strategic oil reserves. "We're gonna do something great with crypto because we don't want China or anybody else – not just China but others are embracing it – and we want to be the head," Trump stated.

Adding to market optimism, MicroStrategy's upcoming inclusion in the Nasdaq 100 index has attracted investor attention. The software company, now the largest corporate holder of Bitcoin, has seen its shares rise more than sixfold this year.

Currently, governments worldwide hold 2.2% of Bitcoin's total supply, with the United States possessing nearly 200,000 Bitcoins valued at over $20 billion. Other major holders include China, UK, Bhutan, and El Salvador.

While excitement builds around potential government adoption, some experts urge caution. Federal Reserve Chair Jerome Powell has compared Bitcoin to gold, and analysts suggest implementing such reserves would require considerable time and planning.

The cryptocurrency market's total value has nearly doubled this year, reaching $3.8 trillion according to CoinGecko. Trump's administration appears poised to embrace digital assets, with recent appointments including former PayPal executive David Sacks as White House cryptocurrency czar and plans to nominate pro-crypto attorney Paul Atkins to lead the Securities and Exchange Commission.

The dramatic shift in Trump's stance on cryptocurrencies, having previously labeled them a scam, reflects broader changes in the political landscape as digital assets gain mainstream acceptance.