Bitcoin Reserve Plan Emerges as Musk Sounds Alarm on U.S. Debt Crisis

Elon Musk expresses grave concerns over America's spiraling $36 trillion debt, while the Trump administration explores establishing a national Bitcoin reserve. The initiatives include a new Doge-inspired department led by Musk that has reportedly generated $100 billion in savings.

Barclays Makes $131M Strategic Investment in BlackRock's Bitcoin ETF

Barclays Bank has invested $131 million in BlackRock's Bitcoin ETF, marking a significant milestone in institutional crypto adoption. The investment follows increased interest after the US election and aligns with other major banks expanding their Bitcoin ETF holdings.

CAR President Launches Controversial Meme-Coin Despite Previous Bitcoin Setbacks

Central African Republic's President Touadéra unveils $CAR cryptocurrency as an experimental initiative to boost development, despite its 90% post-launch plunge. The move follows CAR's limited success with Bitcoin adoption in 2022, raising both hopes and concerns about the nation's crypto ambitions.

Bitcoin Dips as Unexpected US Inflation Jump Dampens Rate Cut Hopes

Bitcoin and major cryptocurrencies declined after US January inflation hit 3.0%, exceeding forecasts and raising concerns about delayed Federal Reserve rate cuts. Fed Chair Powell's Senate testimony emphasized a cautious approach, suggesting higher rates may persist longer than markets anticipated.

Japan Plans Major Crypto Reform: 20% Tax Rate and Bitcoin ETF Approval by 2025

Japan's FSA considers reducing crypto tax from 55% to 20% and lifting the Bitcoin ETF ban as part of a comprehensive regulatory overhaul. The reforms, expected by 2025, aim to boost Japan's competitiveness in the global digital asset market while enhancing investor protection.

SIX Exchange Pioneers Crypto Collateral Integration for Traditional Finance

Swiss exchange operator SIX launches Digital Collateral Service enabling institutions to use cryptocurrencies alongside traditional assets as collateral. The groundbreaking platform supports seven major cryptocurrencies and streamlines collateral management through a unified system.

Man's £598M Bitcoin Quest: Plans to Buy Landfill Where Lost Fortune Lies

A British IT worker aims to purchase an entire landfill site in Wales where he believes his accidentally discarded hard drive containing 7,500 Bitcoins lies buried. After a decade of failed recovery attempts, James Howells sees a new opportunity as the site plans to close for conversion into a solar farm.

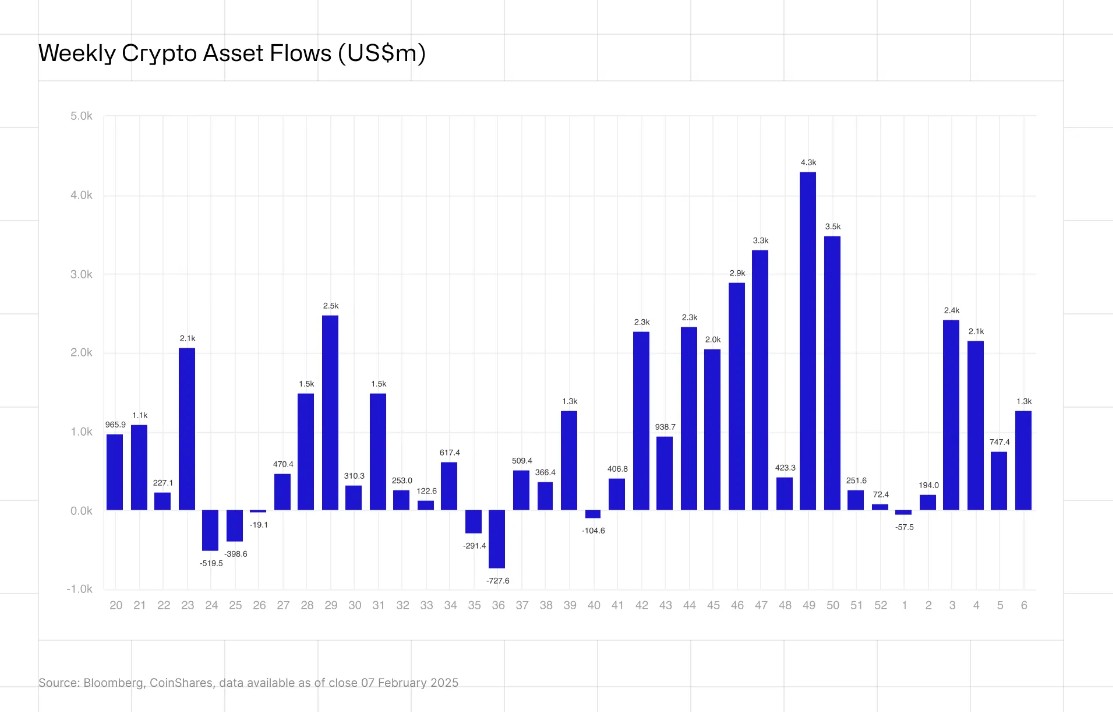

Crypto Investment Products Hit $1.3B Weekly Inflows Despite Trump Trade Tensions

Digital asset investment products maintained strong momentum with $1.3B in weekly inflows, led by Ethereum's $793M, despite market uncertainty around Trump's tariff rhetoric. The surge marks the fifth consecutive week of positive flows, pushing 2024's total to $7.3B while US dominates regional investments.

Lost Bitcoin Fortune: $750M Hard Drive to Be Sealed in Welsh Landfill

A British man's desperate quest to recover 7,500 bitcoins worth $750 million from a Welsh landfill faces a final setback as local authorities prepare to permanently seal the site. The council plans to repurpose the area into a solar farm, forever burying what could have been one of the largest individual cryptocurrency fortunes.

Hong Kong Opens Immigration Path for Bitcoin and Ethereum Investors

Hong Kong now accepts Bitcoin and Ethereum as valid proof of assets for investment immigration, with at least two successful applicants already approved. The groundbreaking policy requires crypto holdings worth HK$30 million stored in cold wallets or established exchanges.