SEC Greenlights Ethereum ETF Options Trading, Expanding Crypto Investment Landscape

The SEC has approved options trading for multiple Ethereum ETFs, marking a significant milestone in cryptocurrency's integration with traditional finance. This development allows investors to trade options contracts on Ethereum ETFs from major institutions like BlackRock and Grayscale, enabling price speculation and risk management.

Coinbase's Strategic Pivot: The Race to Dominate Crypto Banking and Payments

Coinbase is aggressively expanding into crypto payments with its venture arm dedicating nearly 24% of investments to payment solutions, outpacing industry averages. The exchange's growing influence in stablecoins and partnerships with financial giants signals clear ambitions to become a central player in crypto banking.

SEC Engages with BlackRock and Industry Leaders on Crypto ETF Regulatory Framework

The SEC's Crypto Task Force held strategic meetings with BlackRock and the Crypto Council for Innovation to discuss cryptocurrency ETP regulations and staking models. These discussions mark a significant step in developing clear guidelines for crypto financial products while addressing technical and legal considerations.

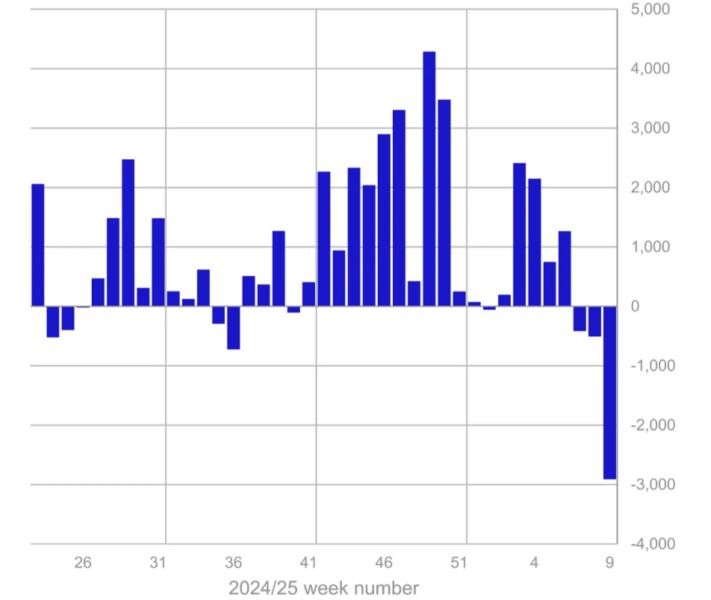

Crypto ETPs Hit by Historic $2.9B Weekly Exodus as Bitcoin Bears Strike

Cryptocurrency exchange-traded products faced unprecedented $2.9B in outflows last week, with Bitcoin taking the heaviest hit at $2.6B withdrawn. The dramatic reversal follows 19 weeks of steady inflows, impacting major providers like BlackRock and Grayscale while smaller crypto assets show resilience.

BlackRock Integrates Bitcoin ETF into Model Portfolios with Conservative Allocation

BlackRock, managing over $11 trillion in assets, has added its iShares Bitcoin Trust ETF to model portfolios with a 1-2% allocation. The strategic move demonstrates growing mainstream adoption while maintaining a cautious approach to cryptocurrency investment risks.

Bitcoin ETF Market Faces Historic $2.4B Selloff Amid Crypto Downturn

Spot Bitcoin ETFs experience their largest outflows since launch, with investors withdrawing over $2.4 billion this week amid falling crypto prices and market uncertainty. Despite the massive selloff, ETF assets remain resilient at $90 billion while the industry continues expanding with new fund applications.

Gen Z Embraces Crypto Over Traditional Retirement Accounts in Investment Shift

A YouGov study reveals that 42% of Gen Z investors hold cryptocurrency compared to just 11% with traditional retirement accounts. This dramatic shift in investment preferences coincides with Bitcoin's rise to $100,000 and increased mainstream acceptance of crypto assets.

Citadel Securities to Enter Crypto Trading as Major Exchange Liquidity Provider

Leading market maker Citadel Securities plans to expand into cryptocurrency trading on major exchanges like Coinbase and Binance, marking a significant shift in strategy. The move follows regulatory clarity under Trump's administration and builds on the firm's existing crypto ventures including partnerships with BlackRock and EDX Markets.

Franklin Templeton Launches Innovative Dual-Crypto ETF Combining Bitcoin and Ethereum

Franklin Templeton expands its digital asset offerings with EZPZ, a groundbreaking ETF providing exposure to both Bitcoin and Ethereum under one ticker. The competitively priced fund allocates 82% to Bitcoin and 18% to Ethereum, with Coinbase serving as custodian.

Invesco Ventures into Digital Assets with Tokenized Private Credit Fund Launch in Singapore

Global investment giant Invesco partners with DigiFT to offer its first tokenized private credit fund, allowing accredited investors entry with just $10,000. The innovative offering features daily redemptions and highlights the growing trend of major asset managers embracing fund tokenization.