Bitcoin Whales Signal Market Caution as Sentiment Weakens Near All-Time Highs

Large Bitcoin holders are increasing exchange deposits while investor confidence deteriorates, creating uncertainty near record prices. However, continued ETF inflows and institutional buying could help stabilize the market amid profit-taking pressure.

Bitcoin Price Could Plunge to $77,000 Before Bull Market Resumes, Says CryptoQuant CEO

CryptoQuant CEO Ki Young Ju forecasts a potential 30% Bitcoin price correction to $77,000, citing historical patterns and institutional entry points. Despite near-term bearish outlook, analysts remain optimistic about long-term growth potential following the April 2024 halving.

Ethereum Price Poised for Major Move as Market Signals Show Mounting Pressure

Despite underperforming in the current bull market, Ethereum shows signs of a potential breakout with record futures open interest and shifting sentiment indicators. Recent developments, including institutional buying and technical signals, suggest ETH could be preparing for significant price action.

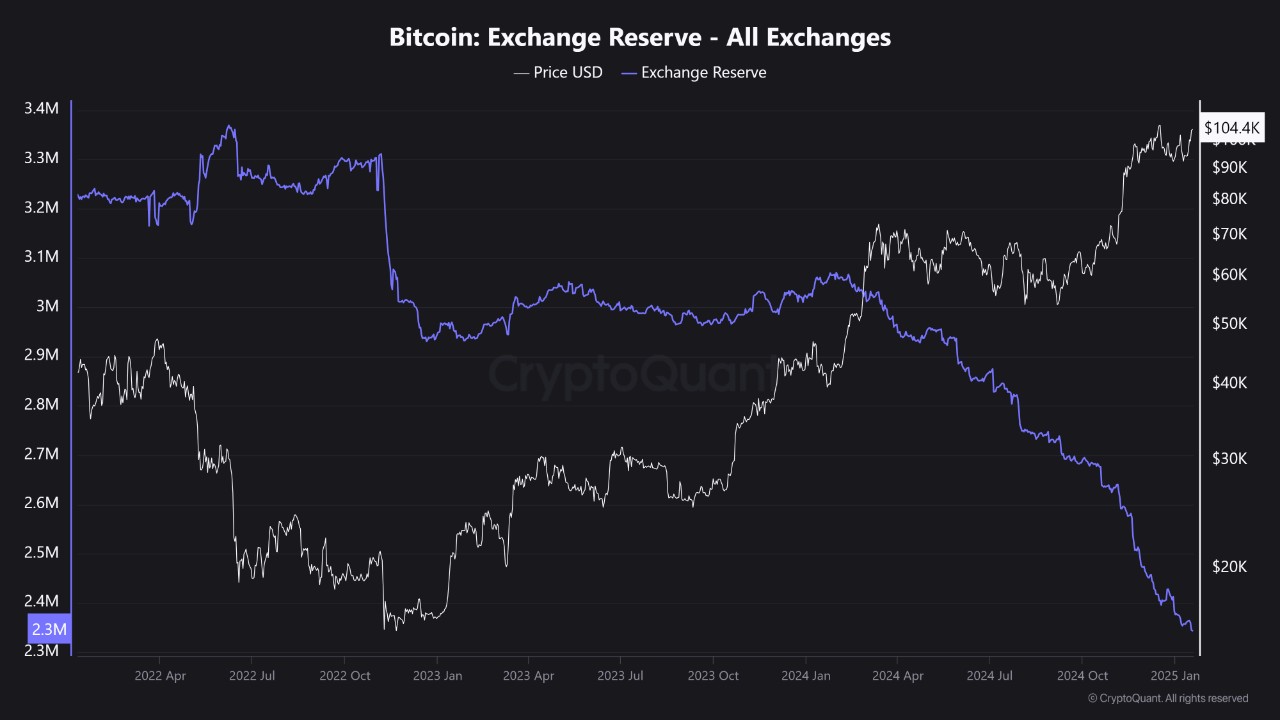

Mass Bitcoin Exodus: 1 Million BTC Vanish from Exchanges in Historic Market Shift

Over one million Bitcoin have been withdrawn from exchanges in the past three years, signaling a dramatic shift in investor behavior. This unprecedented movement, occurring during both bear and bull markets, suggests growing confidence in Bitcoin as a long-term store of value while potentially impacting market liquidity.

Bitcoin Price Could Soar to $249K According to CryptoQuant Analysis

CryptoQuant's latest research identifies three key drivers that could push Bitcoin to unprecedented heights between $145K-$249K: Trump's crypto policies, Fed rate decisions, and Bitcoin's market cycle timing. The prediction follows significant institutional accumulation and ETF launches that helped BTC reach current all-time highs.

Bitcoin Market Resilient: Analysis Shows $6.5B Silk Road Stash Sale Unlikely to Disrupt

CryptoQuant analysis suggests the potential sale of $6.5 billion in Bitcoin seized from Silk Road would have minimal market impact if handled through OTC trading. The cryptocurrency's massive growth in market capitalization provides sufficient cushioning against large-scale liquidations.

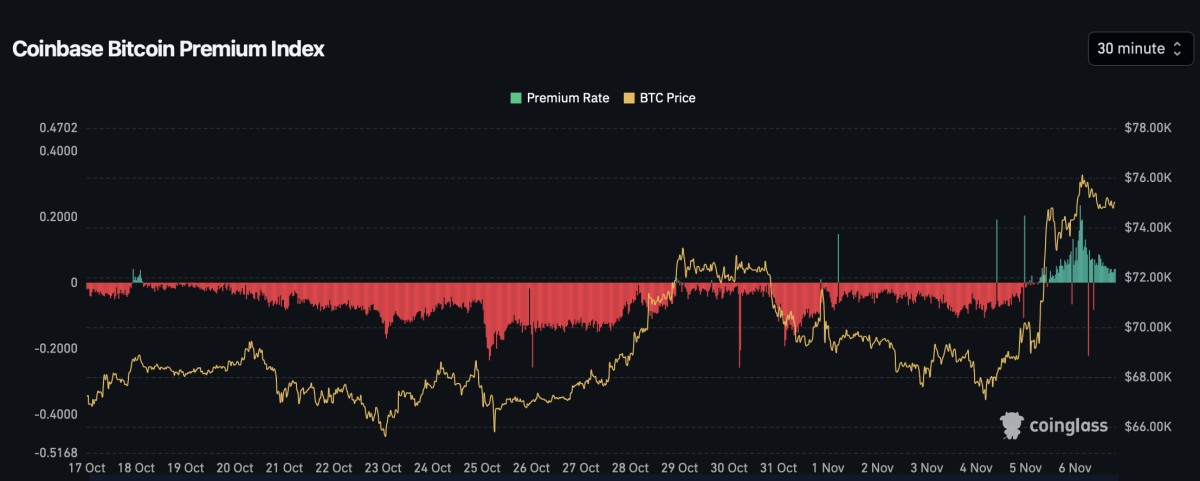

Coinbase Premium Index Turns Positive, Signaling Renewed US Bitcoin Demand

The Coinbase Premium Index has flipped positive for the first time in 2025, indicating growing US institutional interest in Bitcoin as prices surge above $102,000. This key market indicator's reversal from recent lows coincides with substantial BTC outflows and technical breakout signals, suggesting sustained bullish momentum.

Crypto Market Could See Longest Bull Run Ever, Says CryptoQuant CEO

CryptoQuant CEO Ki Young Ju predicts an unprecedented extended crypto bull market as Bitcoin surpasses $100,000 and total market cap hits $3.6T. Industry experts offer varying perspectives on the sustainability of the rally, with some anticipating continued growth while others urge caution.

Tether Maintains Market Dominance Despite EU Exchange Delistings

Despite European exchanges removing USDT to comply with MiCA regulations, CryptoQuant data shows Tether's reserves and market position remain resilient. Exchange reserve metrics indicate steady buying pressure for the leading stablecoin, contradicting fears about its declining influence.

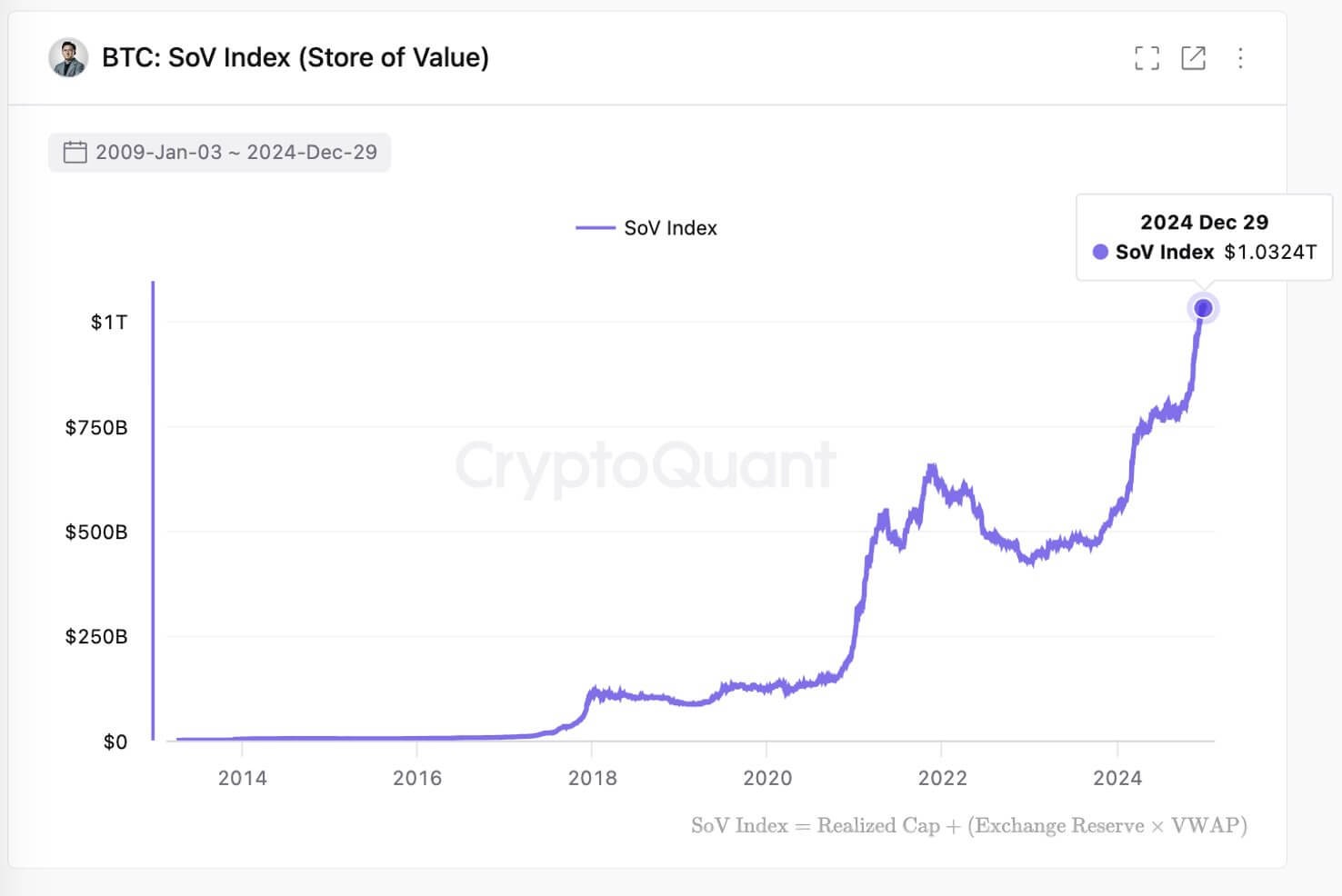

Bitcoin's Real Value Hits $1.03T: New Metric Reveals True Investment Landscape

Bitcoin's stored value surges 85% to $1.03 trillion in 2024, according to CryptoQuant analysis combining on-chain and off-chain data. This new metric offers deeper insights into actual capital invested versus market cap, suggesting growing institutional confidence in Bitcoin as a store of value.