21Shares Pursues Spot Dogecoin ETF Launch with House of Doge Partnership

21Shares files for a spot Dogecoin ETF with the SEC while partnering with House of Doge for a Swiss-listed product. The asset manager expands its $7.3B portfolio as major institutions show growing interest in the popular memecoin.

SEC Greenlights Ethereum ETF Options Trading, Expanding Crypto Investment Landscape

The SEC has approved options trading for multiple Ethereum ETFs, marking a significant milestone in cryptocurrency's integration with traditional finance. This development allows investors to trade options contracts on Ethereum ETFs from major institutions like BlackRock and Grayscale, enabling price speculation and risk management.

Teucrium Launches Groundbreaking 2x Leveraged XRP ETF, First of Its Kind in US

Asset manager Teucrium is making history with the first leveraged XRP ETF launching on NYSE Arca, aiming to deliver double the daily returns. The pioneering move comes amid multiple spot XRP ETF applications under SEC review and follows recent positive regulatory developments for Ripple.

SEC Engages with BlackRock and Industry Leaders on Crypto ETF Regulatory Framework

The SEC's Crypto Task Force held strategic meetings with BlackRock and the Crypto Council for Innovation to discuss cryptocurrency ETP regulations and staking models. These discussions mark a significant step in developing clear guidelines for crypto financial products while addressing technical and legal considerations.

Trump Media and Crypto.com Join Forces to Launch Patriotic Cryptocurrency ETFs

Trump Media & Technology Group partners with Crypto.com to create ETFs focused on digital assets and 'Made in America' investments. The controversial venture faces scrutiny from Democratic lawmakers over potential conflicts of interest with Trump's presidential duties.

Crypto.com and Trump Media Join Forces to Launch 'Made in America' ETFs

Crypto.com partners with Trump Media & Technology Group to create innovative ETFs focused on American investments through the Truth.Fi brand. The collaboration will offer Bitcoin and traditional asset funds to over 140 million users globally, pending regulatory approval.

Bitcoin's Record High Sparks Debate on Next Crypto Bear Market Timeline

As Bitcoin reaches an unprecedented $108,786 in January 2025, experts analyze whether traditional market cycles still apply in an era of institutional adoption. The interplay between historical patterns and new market forces from ETFs and major investors could reshape crypto's trajectory.

Bitcoin Whales Signal Market Caution as Sentiment Weakens Near All-Time Highs

Large Bitcoin holders are increasing exchange deposits while investor confidence deteriorates, creating uncertainty near record prices. However, continued ETF inflows and institutional buying could help stabilize the market amid profit-taking pressure.

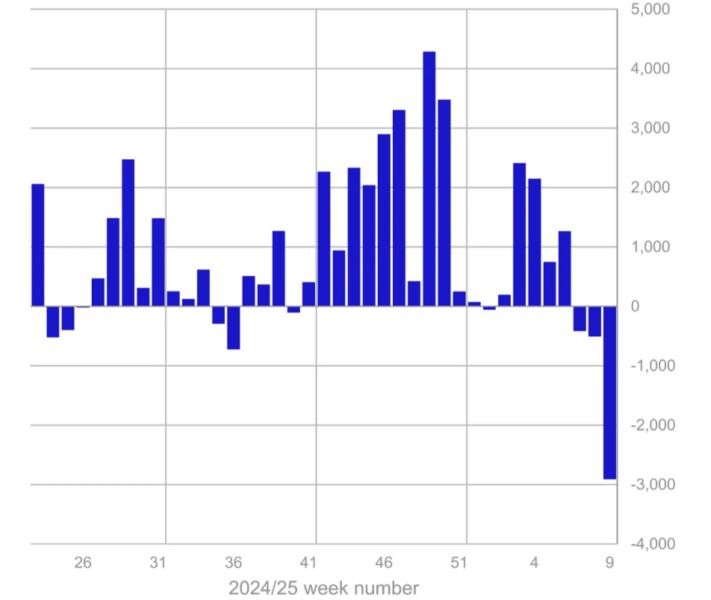

Crypto ETPs Hit by Historic $2.9B Weekly Exodus as Bitcoin Bears Strike

Cryptocurrency exchange-traded products faced unprecedented $2.9B in outflows last week, with Bitcoin taking the heaviest hit at $2.6B withdrawn. The dramatic reversal follows 19 weeks of steady inflows, impacting major providers like BlackRock and Grayscale while smaller crypto assets show resilience.

BlackRock Integrates Bitcoin ETF into Model Portfolios with Conservative Allocation

BlackRock, managing over $11 trillion in assets, has added its iShares Bitcoin Trust ETF to model portfolios with a 1-2% allocation. The strategic move demonstrates growing mainstream adoption while maintaining a cautious approach to cryptocurrency investment risks.