Bitcoin ETF Market Faces Historic $2.4B Selloff Amid Crypto Downturn

Spot Bitcoin ETFs experience their largest outflows since launch, with investors withdrawing over $2.4 billion this week amid falling crypto prices and market uncertainty. Despite the massive selloff, ETF assets remain resilient at $90 billion while the industry continues expanding with new fund applications.

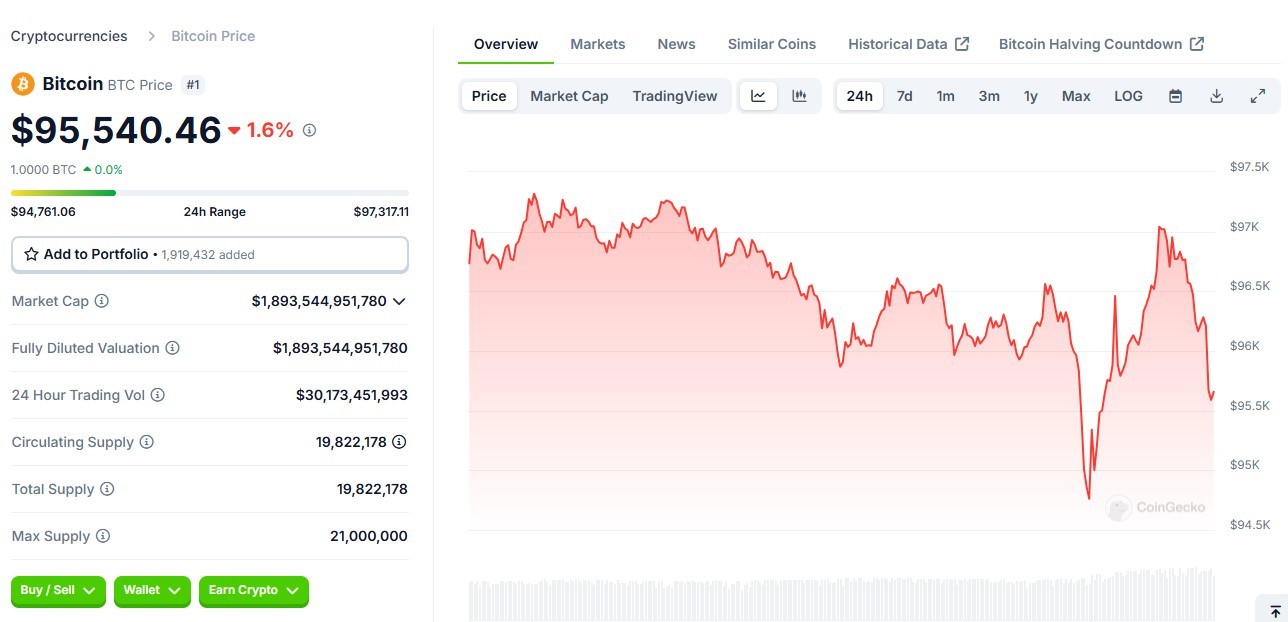

Bitcoin Plunges Below $90,000 as ETF Outflows and Trump Policies Rattle Markets

Bitcoin tumbled to a three-month low of $86,097 amid massive ETF outflows and concerns over Trump's new trade tariffs. The sell-off, compounded by a $1.5B hack at Bybit, has erased nearly half a trillion dollars from the crypto market cap.

Crypto Evolution 2025: Institutional Adoption Drives Market Maturity

The cryptocurrency landscape in 2025 shows significant maturation with Bitwise's $24.1M Bitcoin ETF purchase highlighting growing institutional acceptance. New projects in gaming, DeFi and AI are reshaping the market while focusing on practical utility and technological innovation.

Franklin Templeton Launches Innovative Dual-Crypto ETF Combining Bitcoin and Ethereum

Franklin Templeton expands its digital asset offerings with EZPZ, a groundbreaking ETF providing exposure to both Bitcoin and Ethereum under one ticker. The competitively priced fund allocates 82% to Bitcoin and 18% to Ethereum, with Coinbase serving as custodian.

Brazil Leads Global Markets with First Spot XRP ETF as SEC Reviews Multiple Applications

XRP surged 7.5% to $2.71 as Brazil approved the world's first spot XRP exchange-traded fund while the SEC reviews multiple ETF applications from major asset managers. The developments come amid ongoing regulatory scrutiny and Ripple's legal battle with the SEC over a $1.3 billion lawsuit.

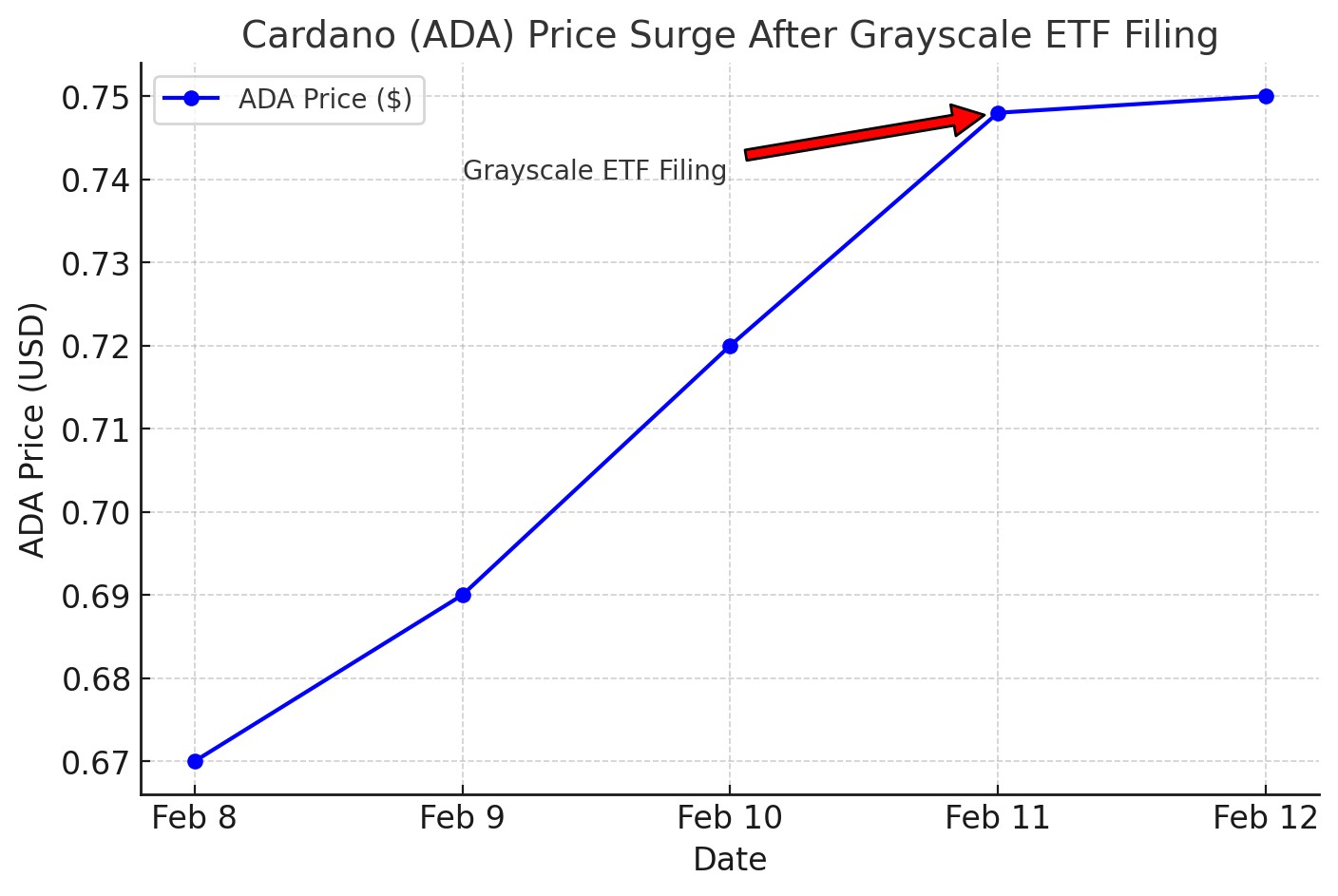

Grayscale's Cardano ETF Filing Ignites ADA Price Rally

Grayscale Investments has filed for a spot Cardano ETF with the SEC, triggering significant market interest and price movement. The proposed ETF aims to provide regulated ADA exposure through established custodians while capitalizing on growing institutional appetite for digital assets.

Barclays Makes $131M Strategic Investment in BlackRock's Bitcoin ETF

Barclays Bank has invested $131 million in BlackRock's Bitcoin ETF, marking a significant milestone in institutional crypto adoption. The investment follows increased interest after the US election and aligns with other major banks expanding their Bitcoin ETF holdings.

SEC Begins Review of Grayscale XRP Trust ETF Proposal Amid Market Rally

The SEC has initiated its evaluation of NYSE Arca's proposal to list the Grayscale XRP Trust as an ETF, beginning a 21-day public comment period. The news sparked positive market reaction, with XRP's price climbing 3.12% amid broader implications for the cryptocurrency's regulatory status.

Japan Plans Major Crypto Reform: 20% Tax Rate and Bitcoin ETF Approval by 2025

Japan's FSA considers reducing crypto tax from 55% to 20% and lifting the Bitcoin ETF ban as part of a comprehensive regulatory overhaul. The reforms, expected by 2025, aim to boost Japan's competitiveness in the global digital asset market while enhancing investor protection.

SIX Exchange Pioneers Crypto Collateral Integration for Traditional Finance

Swiss exchange operator SIX launches Digital Collateral Service enabling institutions to use cryptocurrencies alongside traditional assets as collateral. The groundbreaking platform supports seven major cryptocurrencies and streamlines collateral management through a unified system.