Marathon Digital Unveils $2B Stock Offering to Bolster Bitcoin Holdings

Marathon Digital Holdings plans a massive $2 billion stock offering, allocating 40% for Bitcoin purchases in a bold expansion strategy. The move positions MARA as the second-largest Bitcoin holder among public companies while diversifying beyond traditional mining operations.

GameStop Weighs $5 Million Bitcoin Investment Following Strategic Proposal

GameStop CEO Ryan Cohen acknowledges proposal from Strive Asset Management to convert $5M of cash reserves into Bitcoin, potentially positioning the gaming retailer as a leading Bitcoin treasury company. The move follows recent accounting changes and comes amid evolving corporate cryptocurrency adoption.

Saylor's Controversial 'Sell a Kidney' Bitcoin Statement Amid MicroStrategy Stock Decline

MicroStrategy's Michael Saylor makes waves with extreme pro-Bitcoin rhetoric, urging followers to 'sell a kidney' amid an 18% Bitcoin decline. His unwavering stance contrasts sharply with MicroStrategy's 28% stock drop, highlighting the volatile nature of crypto-linked investments.

GameStop Considers $5 Billion Bitcoin Investment Following Strive Proposal

GameStop evaluates a bold proposal from Strive Asset Management to convert its $5 billion cash reserves into Bitcoin, potentially becoming the gaming sector's premier Bitcoin treasury company. The proposal comes as GameStop seeks to transform its business model while its shares surge 20% on cryptocurrency investment speculation.

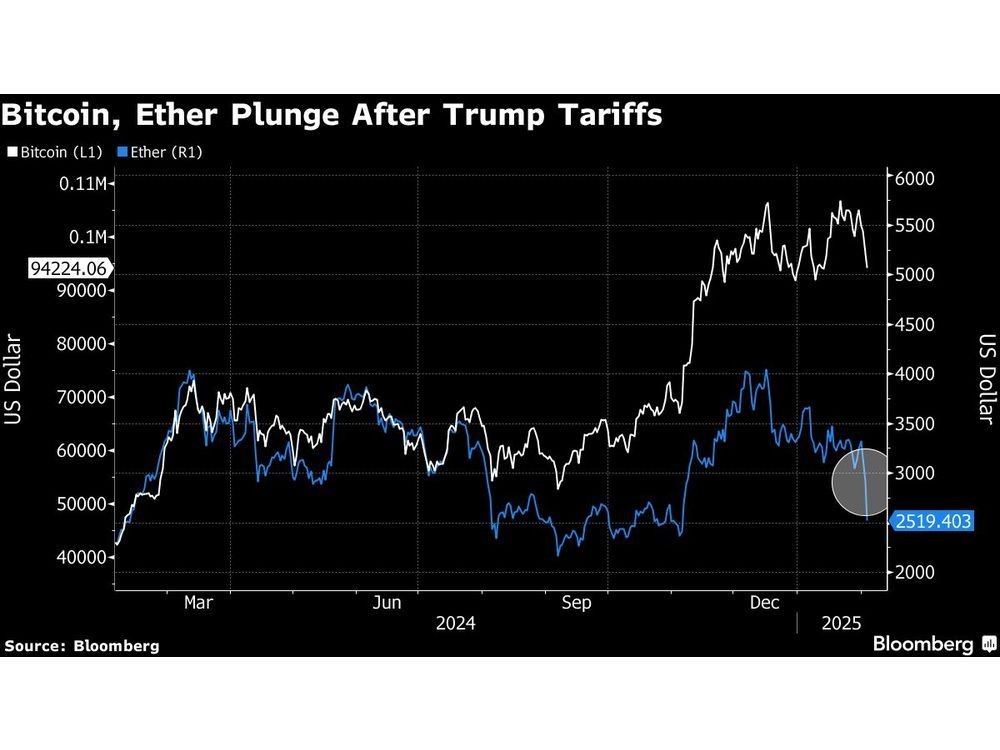

Trade War Tensions Spark Crypto Market Turmoil as Trump's Tariffs Hit Global Markets

President Trump's announcement of extensive tariffs targeting major economies triggered widespread cryptocurrency selloffs, with Bitcoin falling to $91,441 before partial recovery. The meme coin sector was particularly affected, while MicroStrategy's pause in Bitcoin purchases added to market pressure.

Crypto Market Shaken by $555M Liquidation Wave as Bitcoin Dips Below $100K

A massive $555 million crypto liquidation event has pushed Bitcoin below $100,000 and triggered widespread losses across digital assets. Despite the sharp downturn, institutional interest remains strong with MicroStrategy raising funds and market sentiment staying notably optimistic.

Grayscale Unveils Bitcoin-Focused Company ETF Strategy Amid Growing Institutional Interest

Grayscale Investments seeks SEC approval for a novel Bitcoin Adapters ETF targeting companies with significant Bitcoin holdings. The fund aims to invest primarily in firms maintaining billion-dollar Bitcoin reserves, with MicroStrategy emerging as a key potential component.

Market Excess: Hedge Fund Manager Warns of 'Fartcoin' Era in Crypto Trading

Greenlight Capital's David Einhorn raises concerns about speculative cryptocurrency trading, highlighting the $2 billion 'Fartcoin' phenomenon and Trump-related memecoins. His firm responds with strategic trades while warning about market rationality amid renewed optimism.

JPMorgan Predicts Bitcoin's Market Dominance Will Extend Through 2025

JPMorgan analysts forecast Bitcoin to maintain its cryptocurrency market leadership position through 2025, citing institutional adoption and its role as digital gold. The analysis points to MicroStrategy's massive acquisition plans and Bitcoin ETFs as key drivers supporting continued dominance.

MicroStrategy's Bitcoin Buying Spree Continues with $209M Purchase

MicroStrategy maintains its aggressive Bitcoin acquisition strategy with an eighth consecutive weekly purchase, adding 2,138 BTC worth $209 million. The software company's total holdings now reach 446,400 BTC, while its stock outperforms with a 402% gain in 2024.