Tether CEO Reveals Plans for New US-Compliant Stablecoin Amid Regulatory Pressure

Tether CEO Paolo Ardoino announced potential plans to launch a new U.S.-compliant stablecoin if regulations force USDT out of the American market. The $144 billion stablecoin issuer emphasizes commitment to compliance while facing increased scrutiny and proposed legislation requiring strict reserve requirements.

SEC Commissioner Challenges New Stablecoin Guidance, Warns of Market Risks

SEC Commissioner Caroline Crenshaw strongly criticizes the agency's recent stablecoin guidelines, arguing they contain serious legal errors and understate market risks. The controversy emerges as the crypto industry welcomes the new stance while Tether reportedly begins working with a major accounting firm.

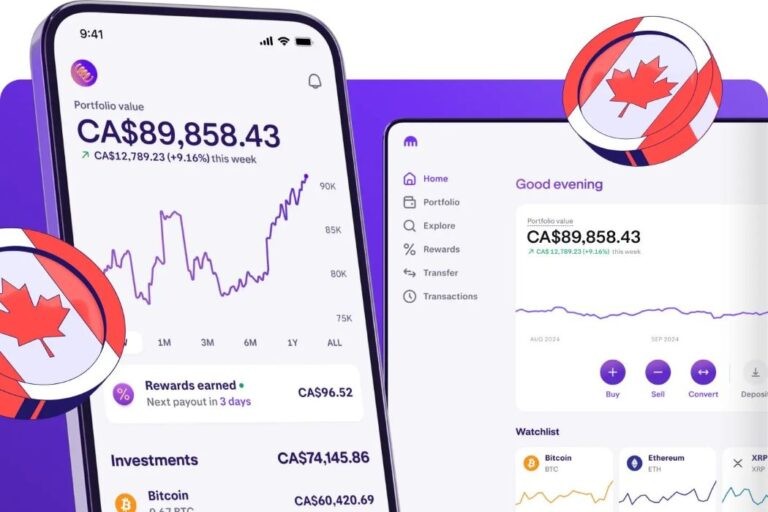

Kraken Secures Regulatory Approval in Canada, Appoints New North America GM

Cryptocurrency exchange Kraken obtains Restricted Dealer registration from Ontario regulators while announcing new leadership. The milestone enables continued Canadian operations under regulatory oversight, as the exchange reports doubled growth and $2B CAD in managed assets.

SEC Dismisses Major Crypto Enforcement Cases in Regulatory Shift

The SEC has dropped enforcement actions against Kraken, ConsenSys, and Cumberland DRW LLC, signaling a significant change in cryptocurrency regulation under new leadership. Acting Chairman Uyeda aims to develop more transparent crypto policies through increased industry engagement and upcoming regulatory roundtables.

U.S. Congress Takes Major Step Toward Digital Asset Clarity with Securities Bill

Representatives Tom Emmer and Darren Soto have reintroduced bipartisan legislation to establish clear regulatory guidelines for digital assets through the Securities Clarity Act. The bill aims to differentiate between digital assets and securities contracts while maintaining consumer protections and fostering innovation.

SEC Expands Crypto Dialogue: Four New Roundtables to Shape Digital Asset Regulation

The SEC announces four additional cryptocurrency roundtables between April-June 2024, focusing on trading, custody, tokenization and DeFi. This expanded initiative under Acting Chairman Uyeda signals an evolution in the agency's approach to developing clear frameworks for digital assets.

U.S. Treasury Lifts Controversial Tornado Cash Sanctions After Court Ruling

The U.S. Treasury has removed sanctions against cryptocurrency mixer Tornado Cash following a court ruling that challenged OFAC's authority. While celebrating innovation in digital assets, officials maintain vigilance against illicit activities as legal proceedings continue against platform founders.

Australia Unveils Ambitious Crypto Integration Plan with New Regulatory Framework

Australian Treasury reveals comprehensive strategy to regulate digital assets and integrate crypto into the national financial system, introducing Digital Asset Platforms licensing framework. The initiative addresses de-banking issues and aims to transform Australia's financial landscape by 2025.

Minnesota Pioneers Crypto Integration with Bold Bitcoin Investment Bill

Minnesota State Senator Jeremy Miller introduces groundbreaking legislation allowing state investments in Bitcoin and cryptocurrencies. The Minnesota Bitcoin Act would enable crypto tax payments, retirement account inclusion, and tax exemptions on gains, positioning the state at the forefront of digital asset adoption.

Trump-Themed Meme Coin Crashes 80%, Wiping Out $12 Billion in Value

Former president Trump's cryptocurrency venture sees devastating losses as his themed meme coin plummets from $73 to $11, erasing billions in market value. The crash prompts new legislation aimed at preventing political figures from profiting through meme coins.