Crypto Market Could See Longest Bull Run Ever, Says CryptoQuant CEO

CryptoQuant CEO Ki Young Ju predicts an unprecedented extended crypto bull market as Bitcoin surpasses $100,000 and total market cap hits $3.6T. Industry experts offer varying perspectives on the sustainability of the rally, with some anticipating continued growth while others urge caution.

Ethereum Hits $3,700 as Layer 2 Networks Drive Mainstream Adoption

Ethereum reaches new heights as Layer 2 networks process 4.5x more transactions than mainnet, with over $11 billion in stablecoins locked. While institutional sentiment remains mixed, technical indicators and accumulation patterns point to continued momentum.

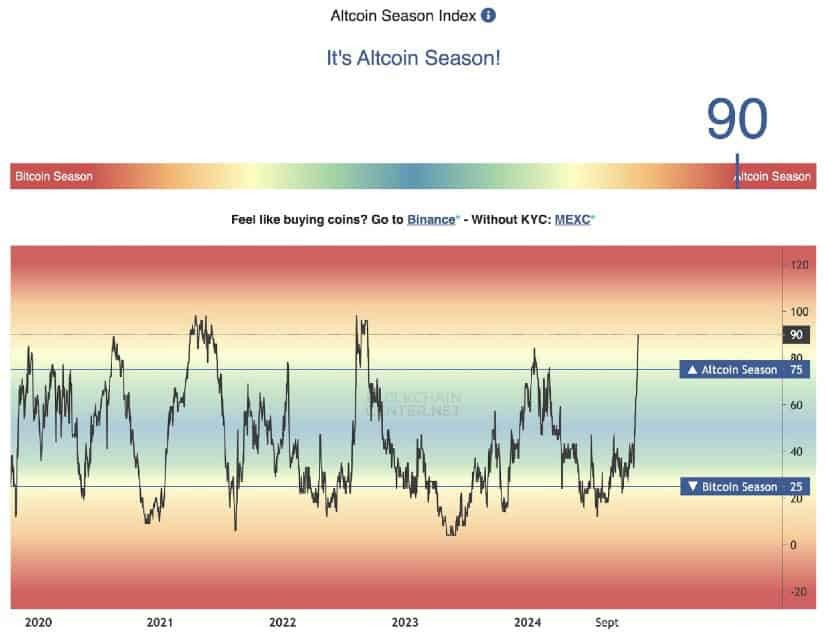

Altcoin Season on the Horizon: Key Technical Signals Point to Major Rally

Cryptocurrency analysts identify market patterns suggesting an imminent altcoin rally, mirroring conditions from previous bull runs in 2017 and 2021. Technical indicators, including Bitcoin's interaction with Bollinger Bands and historical cycle data, point to a potential shift favoring alternative cryptocurrencies.

Ethereum Price Analysis: Multiple Bullish Patterns Point to $6K Target by Early 2025

Technical analysts identify promising chart patterns and market indicators suggesting Ethereum could reach $6,000 by Q1 2025. Strong ETF inflows, increased long-term holder behavior, and historical performance during election years support the bullish outlook.

Bitcoin Sentiment Cools as Price Retreats to $93K in Year-End Slump

Bitcoin's market sentiment indicator drops to 65 from November's peak of 94, reflecting waning investor confidence despite remaining in 'greed' territory. The leading cryptocurrency has declined 13.7% over 12 days as traders seek refuge in stablecoins amid technical predictions of continued price volatility.

Bitcoin Price Watch: Binance's Shrinking Reserves Mirror Pre-Rally Pattern

Binance's Bitcoin reserves have fallen below 570,000 BTC, echoing conditions that preceded a 90% price surge in early 2024. With Bitcoin trading at $98,680 and showing strong market dominance, analysts speculate on potential price movements while investors move assets to cold storage.

Crypto Market Balance: Altcoin Season Index Holds at 51, Signaling Mixed Momentum

The cryptocurrency market's Altcoin Season Index maintains a neutral position at 51, suggesting a balanced trading environment between Bitcoin and alternative cryptocurrencies. This steady reading indicates sustained momentum in the altcoin sector while reflecting mixed market sentiment, with neither Bitcoin nor altcoins establishing clear dominance.

Bitcoin's Massive Exchange Exodus: $2.25B Withdrawal Signals Potential Rally to New Heights

A staggering $2.5 billion worth of Bitcoin has been moved off exchanges in the past week, suggesting growing investor confidence in long-term holding. This substantial outflow, combined with positive market indicators, could set the stage for Bitcoin to challenge its all-time high of $108,388.

Ethereum Whales Make Billion-Dollar Move: 340,000 ETH Accumulated in Just 4 Days

Major Ethereum investors have demonstrated strong conviction by accumulating $1 billion worth of ETH in a massive 96-hour buying spree. This significant whale activity, occurring despite recent market volatility, suggests strategic positioning ahead of potential market movements.

Ethereum Struggles at $4,000: Market Sentiment and Technical Analysis Point to Uncertain Future

Ethereum faces significant hurdles as it fails to breach the $4,000 resistance level for the third time in March 2024, dropping 6.7% to $3,400. Multiple factors including ETF outflows, supply concerns, and technical indicators paint a complex picture for ETH's near-term trajectory.