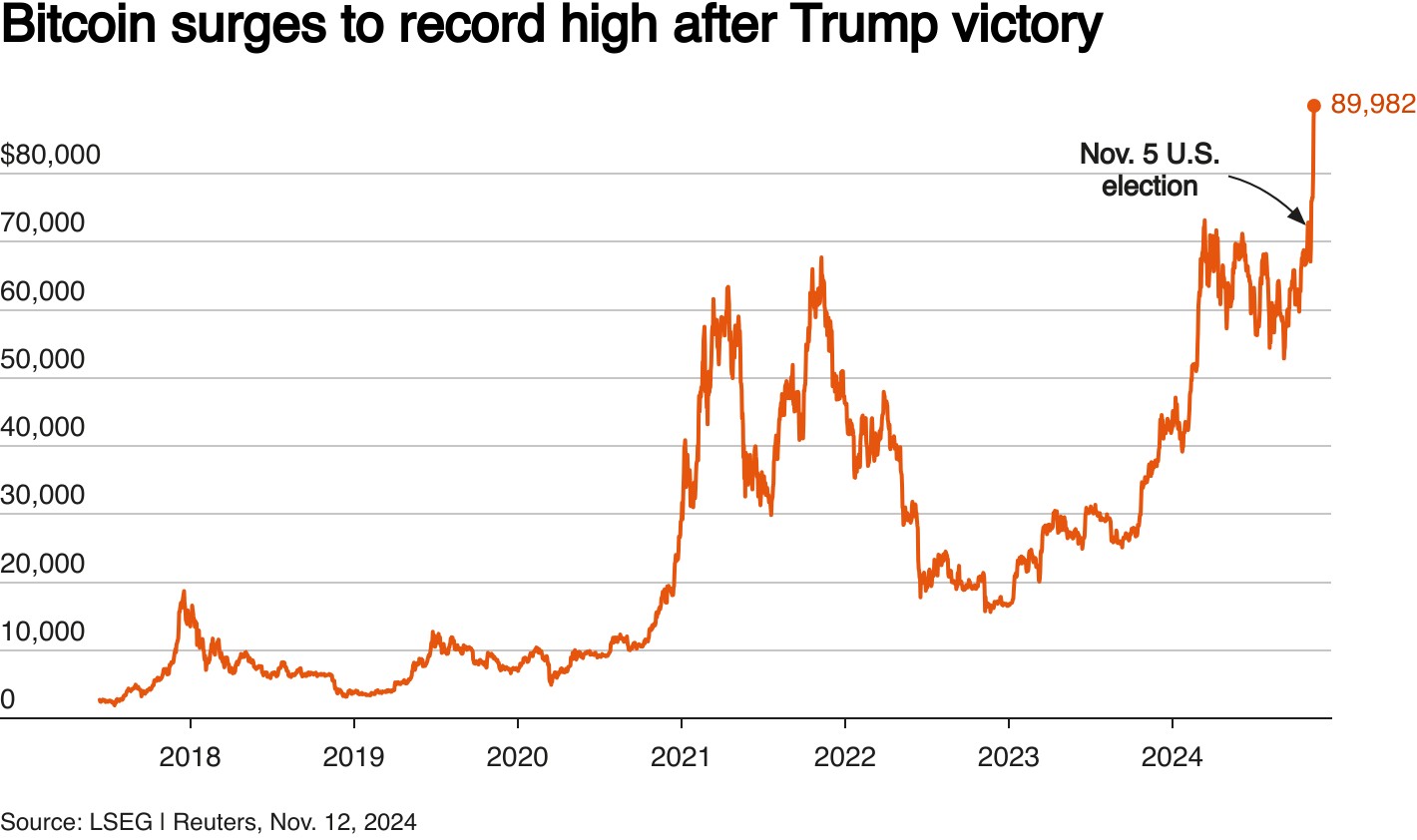

Bitcoin reached unprecedented heights Wednesday, briefly touching $91,085 as the cryptocurrency market continues to rally following Donald Trump's election victory. The world's leading digital currency has surged over 30% since Trump's Nov. 5 win, reflecting renewed optimism in the crypto sector.

The price surge comes as Trump, once skeptical of cryptocurrencies, pledged sweeping pro-crypto policies including establishing a strategic Bitcoin reserve and positioning the US as a global crypto hub. The president-elect's dramatic shift in stance followed substantial campaign spending by digital asset companies advocating for industry-friendly regulations.

Market analysts remain divided on Bitcoin's trajectory through year-end. While many project the cryptocurrency reaching $100,000, others suggest the recent rally may have already priced in much of the positive sentiment.

"A market breather would be welcome, but it is likely to be short. The tailwinds are still strong," noted Noelle Acheson, author of the Crypto Is Macro Now newsletter.

The broader crypto market has also benefited from Trump's victory, with Dogecoin emerging as a standout performer. The meme-inspired cryptocurrency jumped 80% over five days, boosted by Trump's announcement that Elon Musk would co-lead a new Department of Government Efficiency.

However, questions linger about the timing and implementation of Trump's crypto agenda, as his administration may prioritize other policy matters like US-China relations and economic reforms. Additionally, rising Treasury yields and a strengthening dollar suggest inflationary concerns about Trump's proposed trade tariffs and tax cuts could impact crypto markets.

US Bitcoin ETF inflows exceeded $1 billion early this week, highlighting sustained institutional interest. Options market data shows traders are actively betting on Bitcoin reaching $100,000, though analysts caution that market volatility may persist.