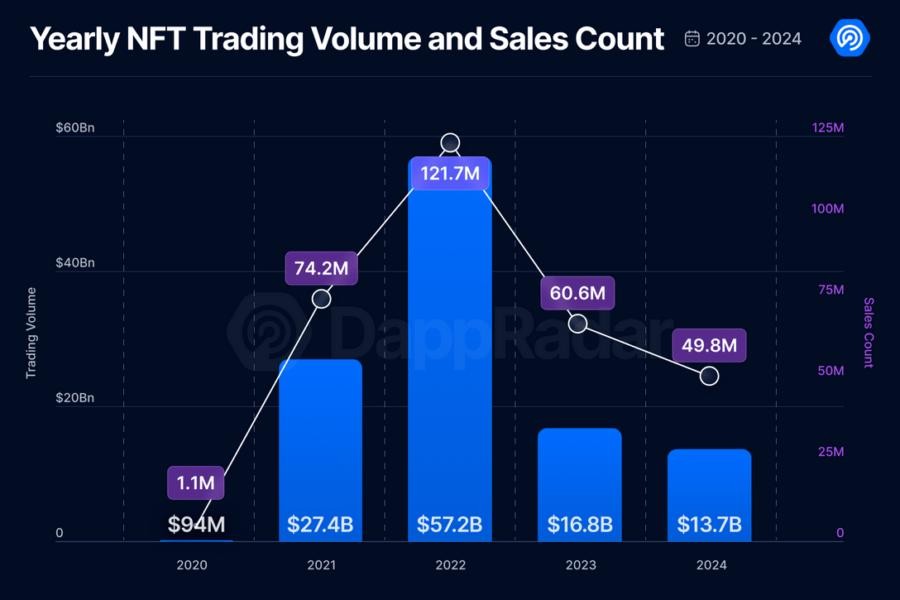

The non-fungible token (NFT) market struggled through 2024, marking its weakest performance since 2020 despite the broader crypto market rally. Trading volumes and sales numbers painted a challenging picture for the NFT space throughout the year.

After a promising start with $5.3 billion in trading volume during Q1, the market witnessed a sharp decline to $1.5 billion by Q3. Though Q4 showed some recovery reaching $2.6 billion, the overall yearly performance remained subdued with a 19% drop in trading volume and 18% decrease in sales compared to 2023.

The gaming sector emerged as a bright spot, leading NFT sales as players embraced digital asset ownership within games. This trend highlighted NFTs' practical utility beyond pure speculation.

In the battle of marketplaces, Blur maintained its leadership position through most of 2024, attracting traders with zero-fee policies and strategic token airdrops. However, traditional market leader OpenSea faced multiple challenges, including regulatory pressure from the SEC through a Wells Notice in August. These headwinds forced OpenSea to cut 56% of its workforce in November as it pivoted toward developing "OpenSea 2.0."

Magic Eden showed strong performance by expanding beyond its Solana roots to support multiple blockchains including Ethereum, Polygon, and Bitcoin. The platform capped the year with the launch of its ME token and a $700 million airdrop campaign in December.

Industry experts suggest that 2024's performance indicates NFTs may find their true value proposition beyond high prices, serving practical purposes within the broader Web3 ecosystem. The year's results point to a maturing market adjusting to more sustainable growth patterns.