Bankman-Fried's Parents Seek Trump Pardon Following 25-Year Sentence

Stanford professors Joseph Bankman and Barbara Fried are pursuing a presidential pardon from Donald Trump for their son Sam Bankman-Fried, who was recently sentenced to 25 years for FTX fraud. The effort follows Trump's pardon of Silk Road founder Ross Ulbricht and comes amid successful FTX bankruptcy proceedings.

Ross Ulbricht's Hidden Bitcoin Fortune: Over 400 BTC Discovered in Untouched Wallets

On-chain researcher Conor Grogan has identified 430 BTC worth $44 million in wallets linked to recently pardoned Silk Road founder Ross Ulbricht. While the discovery suggests a potential windfall, questions remain about Ulbricht's ability to access these long-dormant funds after his 13-year imprisonment.

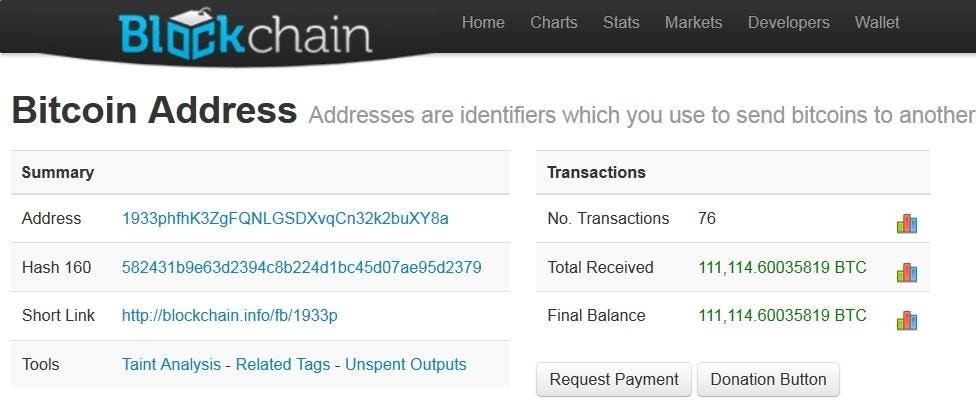

Kraken's Donation to Ross Ulbricht Coincides with Discovery of $47M Bitcoin Fortune

Cryptocurrency exchange Kraken donates $111,111 in Bitcoin to support pardoned Silk Road founder Ross Ulbricht. The donation comes as dormant wallets containing 430 BTC worth $47M, potentially linked to Ulbricht, spark intrigue in the crypto community.

Government's Bitcoin Sales Cost Taxpayers $18.5 Billion in Lost Value

Senator Cynthia Lummis investigates U.S. Marshals Service's controversial practice of selling seized Bitcoin assets, revealing $18.5 billion in unrealized losses. The investigation focuses on the Silk Road case and questions federal cryptocurrency management policies that may have disadvantaged American taxpayers.

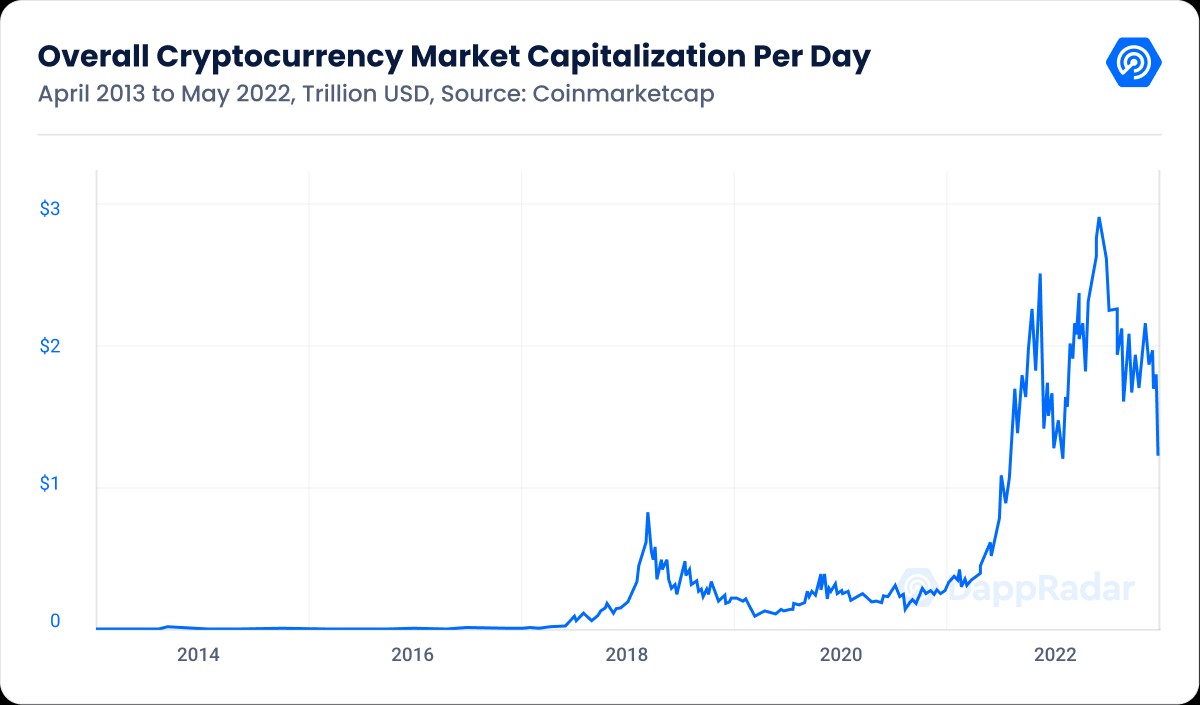

Bitcoin Market Resilient: Analysis Shows $6.5B Silk Road Stash Sale Unlikely to Disrupt

CryptoQuant analysis suggests the potential sale of $6.5 billion in Bitcoin seized from Silk Road would have minimal market impact if handled through OTC trading. The cryptocurrency's massive growth in market capitalization provides sufficient cushioning against large-scale liquidations.

Crypto Market Tumbles as Bitcoin ETF Outflows Hit Record High

The cryptocurrency market extends its decline for the third day, with Bitcoin falling to $91,300 amid massive ETF outflows and macroeconomic concerns. Over 130,000 traders faced liquidations totaling $404 million as the total crypto market cap dropped 4.4% to $3.38 trillion.

DOJ Set to Liquidate $6.5B in Seized Silk Road Bitcoin

The U.S. Department of Justice received approval to sell 69,370 bitcoins worth $6.5B seized from the Silk Road dark web marketplace. The planned sale, citing Bitcoin's volatility, represents a significant portion of the government's crypto holdings and comes amid speculation over its timing relative to the 2024 election.

US Government Transfers $2 Billion in Seized Bitcoin to Coinbase

The US government has moved nearly 20,000 Bitcoin worth $2 billion to Coinbase Prime, marking one of its largest crypto transfers from Silk Road seizures. The transfer sparked market speculation but prices remained stable, while the government still holds substantial cryptocurrency assets.