Trump Announces Historic White House Crypto Summit, Signals Major Policy Shift

President Trump will host the first-ever White House Crypto Summit on March 7, gathering industry leaders and policymakers to shape the future of digital assets. The landmark event, led by key administration officials, marks a dramatic reversal from previous regulatory positions and aims to position America as a global cryptocurrency leader.

Ethereum's Record February Plunge: ETH Price Faces Critical Support Test

Ethereum experiences its worst February performance ever, plummeting 27.48% amid intense market selling pressure. Technical indicators suggest further bearish momentum as ETH breaks multiple support levels, with analysts eyeing potential drops to $1,880.

German Banking Giant DekaBank Embraces Crypto with New Institutional Services

DekaBank, managing $395 billion in assets, launches comprehensive cryptocurrency trading and custody services for institutional clients after securing key regulatory approvals. The move signals growing mainstream acceptance of digital assets in Germany's traditional banking sector.

U.S. Law Enforcement Recovers $31M from Uranium Finance Crypto Heist

U.S. authorities have successfully recovered $31 million in cryptocurrency stolen during the 2021 Uranium Finance hack, representing 62% of the total theft. The breakthrough came through joint efforts between federal agencies, with assistance from on-chain investigators tracking the hacker's attempts to obscure funds through mixers and exchanges.

Gen Z Embraces Crypto Over Traditional Retirement Accounts in Investment Shift

A YouGov study reveals that 42% of Gen Z investors hold cryptocurrency compared to just 11% with traditional retirement accounts. This dramatic shift in investment preferences coincides with Bitcoin's rise to $100,000 and increased mainstream acceptance of crypto assets.

Citadel Securities to Enter Crypto Trading as Major Exchange Liquidity Provider

Leading market maker Citadel Securities plans to expand into cryptocurrency trading on major exchanges like Coinbase and Binance, marking a significant shift in strategy. The move follows regulatory clarity under Trump's administration and builds on the firm's existing crypto ventures including partnerships with BlackRock and EDX Markets.

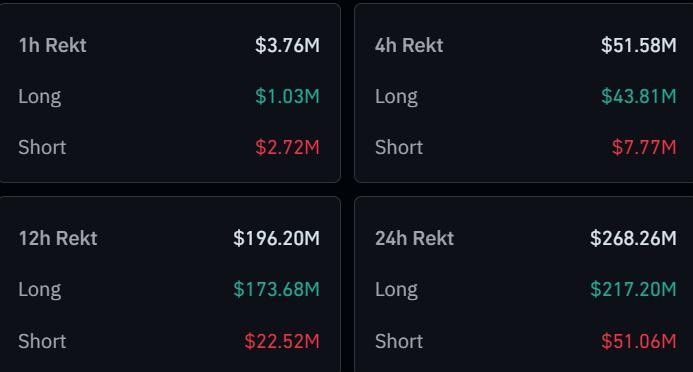

Crypto Market Shakeout: $200M in Long Positions Liquidated as Altcoins Tumble

A massive liquidation event hit the crypto derivatives market, wiping out over $200 million in leveraged long positions as major altcoins faced sharp declines. Ethereum and Solana led the cascade with $56M and $33M in liquidations respectively, while Bitcoin showed relative stability.

Bybit Exchange Hit by $1.46 Billion Ethereum Wallet Hack

Major crypto exchange Bybit suffered a sophisticated security breach resulting in the theft of $1.46 billion worth of Ethereum from its cold storage wallet. Despite the massive breach, CEO Ben Zhou assures that customer funds remain secure and fully backed.

Russia Reports Surge in Crypto Crime as Supreme Court Targets Mining Operations

Russian Supreme Court reveals alarming increase in cryptocurrency-related crimes, with illegal mining operations causing $14 million in power grid damages. Authorities respond with new legislation and mining equipment registry while grappling with crypto's role in sanctions evasion.

SEC Launches Specialized Unit to Combat Crypto and Tech-Related Fraud

The SEC establishes the Cyber and Emerging Technologies Unit (CETU) to investigate cryptocurrency scams, AI fraud, and cybersecurity threats. Led by Laura D'Allaird, this 30-person team represents a focused approach to balancing investor protection with technological innovation.